Page 224 - Tata Steel One Report 2024-Eng-Ebook HY

P. 224

Business Operation and Performance Driving Business Towards Sustainability Corporate Governance Policy

Financial Statements

Attachments

Tata Steel (Thailand) Public Company Limited

TNaottaeSsteoetlh(eThCaoinlasnodli)dPatuebdliacnCdoSmeparnayteLiFminiatendcialStatements

Notes to the Consolidated and Separate Financial Statements

For the year ended 31 March 2025

For the year ended 31 March 2025

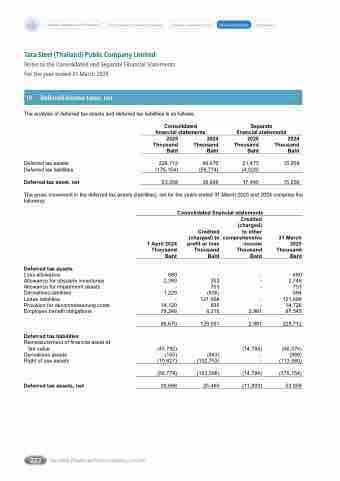

19 Deferred income taxes, net

19 Deferred income taxes, net

The analysis of deferred tax assets and deferred tax liabilities is as follows:

Deferred tax assets Deferred tax liabilities

Deferred tax asset, net

2025 Thousand Baht

228,712 (175,154)

53,558

2024 Thousand Baht

96,670 (56,774)

39,896

2025 Thousand Baht

21,473 (4,028)

17,445

2024 Thousand Baht

15,258 -

15,258 2024 comprise the

Consolidated financial statements

Separate financial statements

The gross movement in the deferred tax assets (liabilities), net for the years ended 31 March 2025 and following:

Consolidated financial statements Credited

Deferred tax assets

Loss allowance

Allowance for obsolete inventories Allowance for impairment assets Derivatives liabilities

Lease liabilities

Provision for decommissioning costs Employee benefit obligations

Deferred tax liabilities

Remeasurement of financial asset at fair value

Derivatives assets Right of use assets

Deferred tax assets, net

1 April 2024 Thousand Baht

680 2,393 - 1,229 - 14,120 78,248

96,670

(45,792) (155) (10,827)

(56,774) 39,896

Credited (charged) to profit or loss Thousand Baht

- 353 753 (635) 121,668 606 6,316

129,061

- (843) (102,753)

(103,596) 25,465

(charged) to other comprehensive income Thousand Baht

-

- - - - -

2,981 2,981

(14,784) - -

(14,784) (11,803)

31 March 2025 Thousand Baht

680 2,746 753 594 121,668 14,726 87,545

228,712

(60,576) (998) (113,580)

(175,154) 53,558

222 Tata Steel (Thailand) Public Company Limited