Page 16 - RosboroAR2018

P. 16

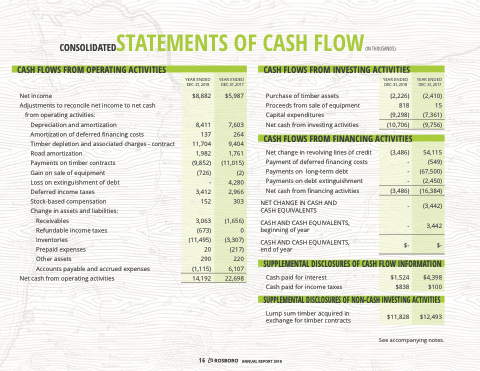

CONSOLIDATEDSTATEMENTS OF CASH FLOW(IN THOUSANDS)

CASH FLOWS FROM INVESTING ACTIVITIES

CASH FLOWS FROM OPERATING ACTIVITIES

YEAR ENDED DEC. 31, 2018

$8,882

8,411 137 11,704 1,982 (9,852) (726) - 3,412 152

3,063 (673) (11,495) 20 290 (1,115)

14,192

YEAR ENDED DEC. 31, 2017

$5,987

7,603 264 9,404 1,761 (11,015) (2) 4,280 2,966 303

(1,656) 0 (3,307) (217) 220 6,107

22,698

Net income

Adjustments to reconcile net income to net cash

from operating activities:

Depreciation and amortization

Amortization of deferred nancing costs

Timber depletion and associated charges - contract Road amortization

Payments on timber contracts

Gain on sale of equipment

Loss on extinguishment of debt

Deferred income taxes

Stock-based compensation

Change in assets and liabilities:

Receivables

Refundable income taxes

Inventories

Prepaid expenses

Other assets

Accounts payable and accrued expenses

Net cash from operating activities

Purchase of timber assets Proceeds from sale of equipment Capital expenditures

Net cash from investing activities

Net change in revolving lines of credit Payment of deferred nancing costs Payments on long-term debt Payments on debt extinguishment Net cash from nancing activities

NET CHANGE IN CASH AND CASH EQUIVALENTS

CASH AND CASH EQUIVALENTS, beginning of year

CASH AND CASH EQUIVALENTS, end of year

Cash paid for interest

Cash paid for income taxes

Lump sum timber acquired in exchange for timber contracts

CASH FLOWS FROM FINANCING ACTIVITIES

(3,486) - - -

54,115 (549) (67,500) (2,450)

(3,486)

(16,384)

- -

$-

(3,442) 3,442

$-

SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION

YEAR ENDED DEC. 31, 2018

(2,226) 818 (9,298)

YEAR ENDED DEC. 31, 2017

(2,410) 15 (7,361)

(10,706)

(9,756)

16

ANNUAL REPORT 2018

SUPPLEMENTAL DISCLOSURES OF NON-CASH INVESTING ACTIVITIES

$1,524 $838

See accompanying notes.

$4,398 $100

$11,828

$12,493