Page 14 - RosboroAR2017

P. 14

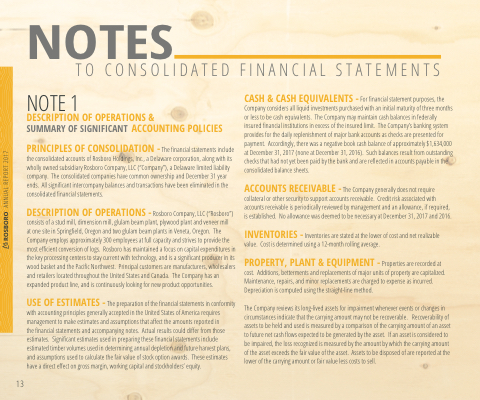

NOTES

CASH & CASH EQUIVALENTS - For nancial statement purposes, the Company considers all liquid investments purchased with an initial maturity of three months or less to be cash equivalents. The Company may maintain cash balances in federally insured nancial institutions in excess of the insured limit. The Company’s banking system provides for the daily replenishment of major bank accounts as checks are presented for payment. Accordingly, there was a negative book cash balance of approximately $1,634,000 at December 31, 2017 (none at December 31, 2016). Such balances result from outstanding checks that had not yet been paid by the bank and are re ected in accounts payable in the consolidated balance sheets.

ACCOUNTS RECEIVABLE - The Company generally does not require collateral or other security to support accounts receivable. Credit risk associated with accounts receivable is periodically reviewed by management and an allowance, if required, is established. No allowance was deemed to be necessary at December 31, 2017 and 2016.

INVENTORIES - Inventories are stated at the lower of cost and net realizable value. Cost is determined using a 12-month rolling average.

PROPERTY, PLANT & EQUIPMENT - Properties are recorded at cost. Additions, betterments and replacements of major units of property are capitalized. Maintenance, repairs, and minor replacements are charged to expense as incurred. Depreciation is computed using the straight-line method.

The Company reviews its long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying amount may not be recoverable. Recoverability of assets to be held and used is measured by a comparison of the carrying amount of an asset to future net cash ows expected to be generated by the asset. If an asset is considered to be impaired, the loss recognized is measured by the amount by which the carrying amount of the asset exceeds the fair value of the asset. Assets to be disposed of are reported at the lower of the carrying amount or fair value less costs to sell.

NOTE 1

TO CONSOLIDATED FINANCIAL STATEMENTS

DESCRIPTION OF OPERATIONS &

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

PRINCIPLES OF CONSOLIDATION - The nancial statements include the consolidated accounts of Rosboro Holdings, Inc., a Delaware corporation, along with its wholly owned subsidiary Rosboro Company, LLC (“Company”), a Delaware limited liability company. The consolidated companies have common ownership and December 31 year ends. All signi cant intercompany balances and transactions have been eliminated in the consolidated nancial statements.

DESCRIPTION OF OPERATIONS - Rosboro Company, LLC (“Rosboro”) consists of a stud mill, dimension mill, glulam beam plant, plywood plant and veneer mill

at one site in Spring eld, Oregon and two glulam beam plants in Veneta, Oregon. The Company employs approximately 300 employees at full capacity and strives to provide the most e cient conversion of logs. Rosboro has maintained a focus on capital expenditures in the key processing centers to stay current with technology, and is a signi cant producer in its wood basket and the Paci c Northwest. Principal customers are manufacturers, wholesalers and retailers located throughout the United States and Canada. The Company has an expanded product line, and is continuously looking for new product opportunities.

USE OF ESTIMATES - The preparation of the nancial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that a ect the amounts reported in

the nancial statements and accompanying notes. Actual results could di er from those estimates. Signi cant estimates used in preparing these nancial statements include estimated timber volumes used in determining annual depletion and future harvest plans, and assumptions used to calculate the fair value of stock option awards. These estimates have a direct e ect on gross margin, working capital and stockholders’ equity.

13