Page 4 - RosboroAR2017

P. 4

3

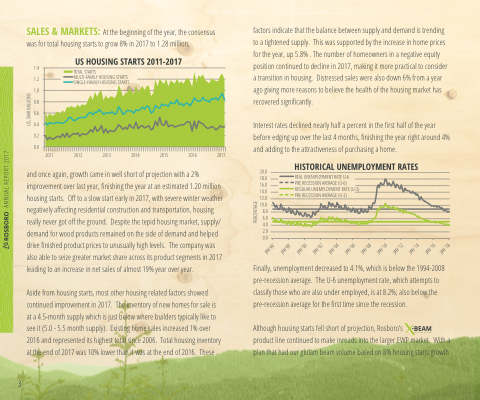

SALES & MARKETS: At the beginning of the year, the consensus was for total housing starts to grow 8% in 2017 to 1.28 million,

factors indicate that the balance between supply and demand is trending to a tightened supply. This was supported by the increase in home prices for the year, up 5.8% . The number of homeowners in a negative equity position continued to decline in 2017, making it more practical to consider a transition in housing. Distressed sales were also down 6% from a year ago giving more reasons to believe the health of the housing market has recovered signi cantly.

Interest rates declined nearly half a percent in the rst half of the year before edging up over the last 4 months, nishing the year right around 4% and adding to the attractiveness of purchasing a home.

and once again, growth came in well short of projection with a 2% improvement over last year, nishing the year at an estimated 1.20 million housing starts. O to a slow start early in 2017, with severe winter weather negatively a ecting residential construction and transportation, housing really never got o the ground. Despite the tepid housing market, supply/ demand for wood products remained on the side of demand and helped drive nished product prices to unusually high levels. The company was also able to seize greater market share across its product segments in 2017 leading to an increase in net sales of almost 19% year over year.

Aside from housing starts, most other housing related factors showed continued improvement in 2017. The inventory of new homes for sale is at a 4.5-month supply which is just below where builders typically like to see it (5.0 - 5.5 month supply). Existing home sales increased 1% over 2016 and represented its highest total since 2006. Total housing inventory at the end of 2017 was 10% lower than it was at the end of 2016. These

Finally, unemployment decreased to 4.1%, which is below the 1994-2008 pre-recession average. The U-6 unemployment rate, which attempts to classify those who are also under employed, is at 8.2%; also below the pre-recession average for the rst time since the recession.

Although housing starts fell short of projection, Rosboro’s

product line continued to make inroads into the larger EWP market. With a plan that had our glulam beam volume based on 8% housing starts growth