Page 186 - Thailand Post Annual Report 2024

P. 186

Part 1

Overview of the Organization

Part 2

Business Trends

Part 3

Business Model

Part 4

Strategies and Resource Allocation

Part 5

Risk

Part 6

Corporate Governance

Part 7

Operating Results

Part 8

Other Information

5.

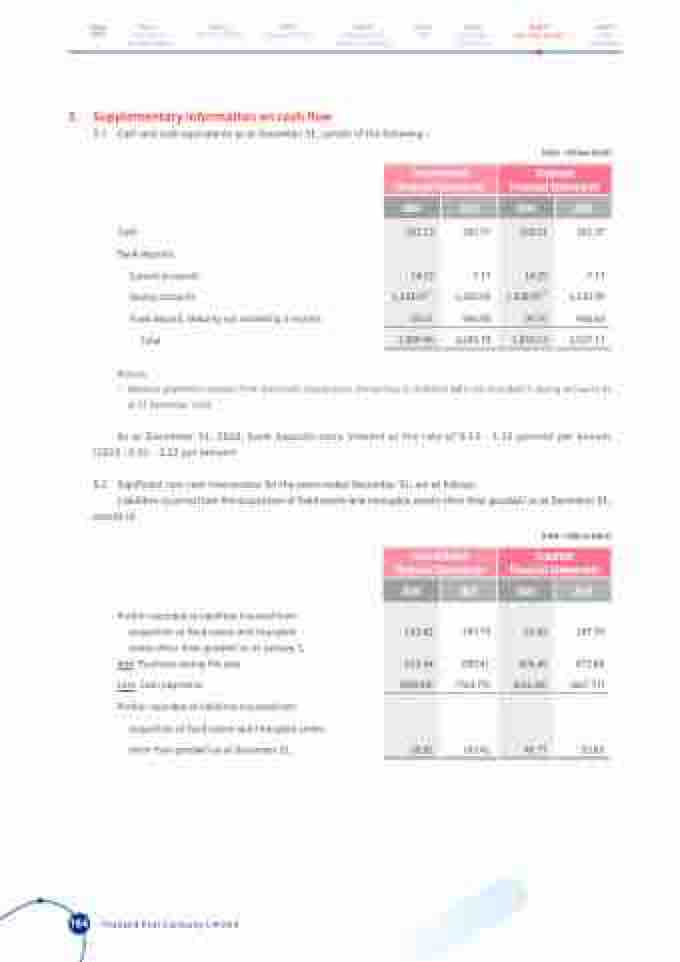

Supplementary information on cash flow

5.1 Cash and cash equivalents as at December 31, consist of the following :

Cash

Bank deposits

Current accounts

Saving accounts

Fixed deposit, Maturity not exceeding 3 months

Total

(Unit : million baht)

Consolidated Financial Statements

Separate Financial Statements

2024

2023

2024

2023

261.13

262.57

7.17 1,429.05 946.95

260.27

262.37

7.17 1,310.99 946.64

14.25

14.25

1,344.07(1)

1,338.92(1)

40.01

39.70

1,659.46

2,645.74

1,653.14

2,527.17

Remark

(1) Advance payments received from electronic transactions amounting to 2,043.02 baht are included in saving accounts as

at 31 December 2024.

As at December 31, 2024, bank deposits carry interest at the rate of 0.13 - 1.15 percent per annum (2023 : 0.01 - 2.20 per annum)

5.2 Significant non-cash transactions for the years ended December 31, are as follows :

Liabilities incurred from the acquisition of fixed assets and intangible assets other than goodwill as at December 31,

consist of :

Portion recorded as liabilities incurred from acquisition of fixed assets and intangible assets other than goodwill as at January 1,

Add Purchase during the year

Less Cash payments

Portion recorded as liabilities incurred from

acquisition of fixed assets and intangible assets other than goodwill as at December 31,

(Unit : million baht)

Consolidated Financial Statements

Separate Financial Statements

2024

2023

2024

2023

247.74

659.41 (763.73)

247.74

473.68 (667.77)

143.42

53.65

613.44

605.40

(698.04)

(612.28)

143.42

53.65

58.82

46.77

184

Thailand Post Company Limited