Page 26 - 2022 Feb Report

P. 26

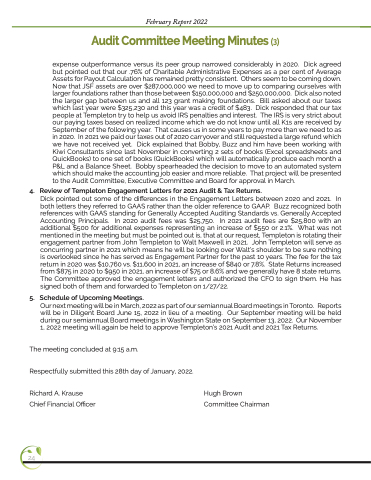

February Report 2022

Audit Committee Meeting Minutes (3)

expense outperformance versus its peer group narrowed considerably in 2020. Dick agreed but pointed out that our .76% of Charitable Administrative Expenses as a per cent of Average Assets for Payout Calculation has remained pretty consistent. Others seem to be coming down. Now that JSF assets are over $287,000,000 we need to move up to comparing ourselves with larger foundations rather than those between $150,000,000 and $250,000,000. Dick also noted the larger gap between us and all 123 grant making foundations. Bill asked about our taxes which last year were $325,230 and this year was a credit of $483. Dick responded that our tax people at Templeton try to help us avoid IRS penalties and interest. The IRS is very strict about our paying taxes based on realized income which we do not know until all K1s are received by September of the following year. That causes us in some years to pay more than we need to as in 2020. In 2021 we paid our taxes out of 2020 carryover and still requested a large refund which we have not received yet. Dick explained that Bobby, Buzz and him have been working with Kiwi Consultants since last November in converting 2 sets of books (Excel spreadsheets and QuickBooks) to one set of books (QuickBooks) which will automatically produce each month a P&L and a Balance Sheet. Bobby spearheaded the decision to move to an automated system which should make the accounting job easier and more reliable. That project will be presented to the Audit Committee, Executive Committee and Board for approval in March.

4. Review of Templeton Engagement Letters for 2021 Audit & Tax Returns.

Dick pointed out some of the differences in the Engagement Letters between 2020 and 2021. In both letters they referred to GAAS rather than the older reference to GAAP. Buzz recognized both references with GAAS standing for Generally Accepted Auditing Standards vs. Generally Accepted Accounting Principals. In 2020 audit fees was $25,750. In 2021 audit fees are $25,800 with an additional $500 for additional expenses representing an increase of $550 or 2.1%. What was not mentioned in the meeting but must be pointed out is, that at our request, Templeton is rotating their engagement partner from John Templeton to Walt Maxwell in 2021. John Templeton will serve as concurring partner in 2021 which means he will be looking over Walt’s shoulder to be sure nothing is overlooked since he has served as Engagement Partner for the past 10 years. The fee for the tax return in 2020 was $10,760 vs. $11,600 in 2021, an increase of $840 or 7.8%. State Returns increased from $875 in 2020 to $950 in 2021, an increase of $75 or 8.6% and we generally have 8 state returns. The Committee approved the engagement letters and authorized the CFO to sign them. He has signed both of them and forwarded to Templeton on 1/27/22.

5. Schedule of Upcoming Meetings.

Our next meeting will be in March, 2022 as part of our semiannual Board meetings in Toronto. Reports will be in Diligent Board June 15, 2022 in lieu of a meeting. Our September meeting will be held during our semiannual Board meetings in Washington State on September 13, 2022. Our November 1, 2022 meeting will again be held to approve Templeton’s 2021 Audit and 2021 Tax Returns.

The meeting concluded at 9:15 a.m.

Respectfully submitted this 28th day of January, 2022.

Richard A. Krause Hugh Brown

Chief Financial Officer Committee Chairman

24