Page 43 - UKZN Foundation AR 2024

P. 43

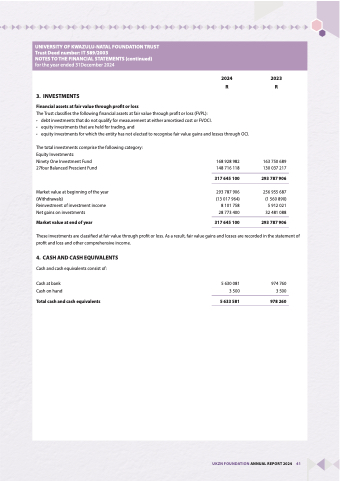

UNIVERSITY OF KWAZULU-NATAL FOUNDATION TRUST Trust Deed number: IT 589/2003

NOTES TO THE FINANCIAL STATEMENTS (continued)

for the year ended 31December 2024

3. INVESTMENTS

Financial assets at fair value through profit or loss

The Trust classifies the following financial assets at fair value through profit or loss (FVPL):

• debt investments that do not qualify for measurement at either amortised cost or FVOCI.

• equity investments that are held for trading, and

• equity investments for which the entity has not elected to recognise fair value gains and losses through OCI.

The total investments comprise the following category: Equity Investments:

Ninety One Investment Fund

27four Balanced Prescient Fund

Market value at beginning of the year (Withdrawals)

Reinvestment of investment income Net gains on investments

Market value at end of year

168 928 982 148 716 118

317 645 100

293 787 906 (13 017 964) 8 101 758 28 773 400

317 645 100

163 750 689 130 037 217

293 787 906

256 955 687 (1 560 890) 5 912 021 32 481 088

293 787 906

2024 2023 RR

These investments are classified at fair value through profit or loss. As a result, fair value gains and losses are recorded in the statement of profit and loss and other comprehensive income.

4. CASH AND CASH EQUIVALENTS

Cash and cash equivalents consist of:

Cash at bank Cash on hand

Total cash and cash equivalents

5 630 081 3 500

5 633 581

974 760 3 500

978 260

UKZN FOUNDATION ANNUAL REPORT 2024 41