Page 38 - UKZN Foundation AR 2023

P. 38

UNIVERSITY OF KWAZULU-NATAL FOUNDATION TRUST Trust Deed number: IT 589/2003

NOTES TO THE FINANCIAL STATEMENTS (continued) for the year ended 31 December 2023

1.13. Standards and interpretations in issue not yet adopted

At the date of authorisation of these financial statements, the following revised standards and interpretations were in issue, but not yet effective: Effective date for annual periods beginning on or after indicated below.

Amendments to iFRS 16 - Lease on sale and leaseback. These amendments include requirements for sale and leaseback transactions in IFRS 16 to explain how and entity accounts for a sale and leaseback after the date of the transaction. Sale and leaseback transactions where some or all the lease payments are variable lease payments that do not depend on an index or rate are most likely impacted. Effective date : 1 January 2024

Amendments to iAS 1 - Non-current liabilities with covenants.These amendments clarify how conditions with which an entity must comply within twelve months after the reporting period affect the classification of a liability. Effective date: 1 January 2024 Amendments to iAS 7 and iFRS - Supplier finance arrangements - The IASB has issued new disclosure requirements

about supplier financing arrangements. The objective of the new disclosure is to provide information about supplier finance arrangements that enables investors to assess the effects

The Trustees are of the opinion that the amendments to these standards will not have a material effect on the financial statements of the Foundation.

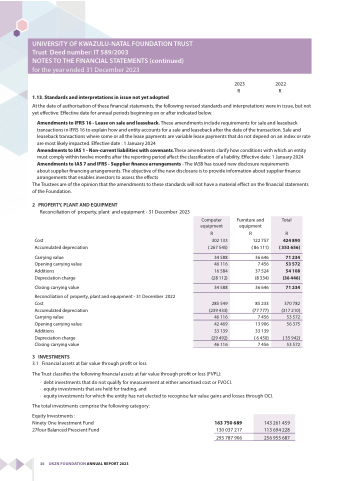

2 PROPERTY, PLANT AND EQUIPMENT

Reconciliation of property, plant and equipment - 31 December 2023

2023 2022 RR

Computer equipment

Furniture and equipment

Total

R

R

R

Cost

302 133

122 757

424 890

Accumulated depreciation

( 267 545)

( 86 111)

( 353 656)

Carrying value

34 588

36 646

71 234

Opening carrying value

46 116

7 456

53 572

Additions

16 584

37 524

54 108

Depreciation charge

(28 112)

(8 334)

(36 446)

Closing carrying value

34 588

36 646

71 234

Reconciliation of property, plant and equipment - 31 December 2022

Cost

285 549

85 233

370 782

Accumulated depreciation

(239 433)

(77 777)

(317 210)

Carrying value

46 116

7 456

53 572

Opening carrying value

42 469

13 906

56 375

Additions

33 139

33 139

Depreciation charge

(29 492)

( 6 450)

( 35 942)

Closing carrying value

46 116

7 456

53 572

3 INVESTMENTS

3.1 Financial assets at fair value through profit or loss

The Trust classifies the following financial assets at fair value through profit or loss (FVPL):

· debt investments that do not qualify for measurement at either amortised cost or FVOCI.

· equity investments that are held for trading, and

· equity investments for which the entity has not elected to recognise fair value gains and losses through OCI.

The total investments comprise the following category:

Equity Investments :

Ninety One Investment Fund 27four Balanced Prescient Fund

163 750 689

130 037 217 293 787 906

143 261 459 113 694 228

256 955 687

36 UKZN FOUNDATiON ANNUAL REPORT 2023