Page 39 - UKZN Foundation AR 2023

P. 39

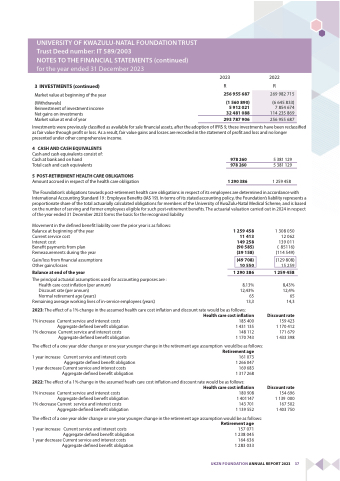

UNIVERSITY OF KWAZULU-NATAL FOUNDATION TRUST Trust Deed number: IT 589/2003

NOTES TO THE FINANCIAL STATEMENTS (continued) for the year ended 31 December 2023

3 iNVESTMENTS (continued)

Market value at beginning of the year

(Withdrawals)

Reinvestment of investment income Net gains on investments

Market value at end of year

2023 2022 R R 256 955 687

(1 560 890) 5 912 021 32 481 088

293 787 906

269 982 715

(6 645 833)

7 854 674

114 235 869

256 955 687

Investments were previously classified as available for sale financial assets, after the adoption of IFRS 9, these investments have been reclassified as fair value through profit or loss. As a result, fair value gains and losses are recorded in the statement of profit and loss and no longer presented under other comprehensive income.

4 CASH AND CASH EQUiVALENTS

Cash and cash equivalents consist of: Cash at bank and on hand

Total cash and cash equivalents

5 POST-RETiREMENT HEALTH CARE OBLiGATiONS

Amount accrued in respect of the health care obligation

978 260 978 260

1 290 386

5 381 129 5 381 129

1 259 458

The Foundation’s obligations towards post-retirement health care obligations in respect of its employees are determined in accordance with International Accounting Standard 19 : Employee Benefits (IAS 19). In terms of its stated accounting policy, the Foundation’s liability represents a proportionate share of the total actuarially calculated obligations for members of the University of KwaZulu-Natal Medical Scheme, and is based

on the number of serving and former employees eligible for such post-retirement benefits. The actuarial valuation carried out in 2024 in respect of the year ended 31 December 2023 forms the basis for the recognised liability.

Movement in the defined benefit liability over the prior year is as follows: Balance at beginning of the year

Current service cost

Interest cost

Benefit payments from plan Remeasurements during the year

Gain/loss from financial assumptions Other gains/losses

Balance at end of the year

The principal actuarial assumptions used for accounting purposes are : Health care cost inflation (per annum)

Discount rate (per annum)

Normal retirement age (years)

Remaining average working lives of in-service employees (years)

1 259 458 11 413 149 258 (90 585) (39 158)

1 290 386

8,13% 12,43% 65 13,3

1 308 050 12 062 139 011 ( 85116) (114 549)

1 259 458

8,43% 12,4% 65 14,3

Discount rate

159 423 1 170 412 171 679 1 433 398

Discount rate

154 696 1 139 000 167 502 1 403 750

2023: The effect of a 1% change in the assumed health care cost inflation and discount rate would be as follows:

1% increase Current service and interest costs Aggregate defined benefit obligation

1% decrease Current service and interest costs Aggregate defined benefit obligation

Health care cost inflation

185 400 1 431 135 148 112 1 170 743

The effect of a one year older change or one year younger change in the retirement age assumption would be as follows:

1 year increase Current service and interest costs Aggregate defined benefit obligation

1 year decrease Current service and interest costs Aggregate defined benefit obligation

Retirement age

161 073 1 266 047 169 683 1 317 268

2022: The effect of a 1% change in the assumed heath care cost inflation and discount rate would be as follows:

1% increase Current service and interest costs Aggregate defined benefit obligation

1% decrease Current service and interest costs Aggregate defined benefit obligation

Health care cost inflation

180 908 1 401147 143 701 1 139 552

The effect of a one year older change or one year younger change in the retirement age assumption would be as follows:

1 year increase Current service and interest costs Aggregate defined benefit obligation

1 year decrease Current service and interest costs Aggregate defined benefit obligation

Retirement age

157 071 1 238 045 164 636 1 283 033

(49 708) 10 550

(129 808) 15 259

UKZN FOUNDATiON ANNUAL REPORT 2023 37