Page 95 - KZN Film A Report

P. 95

KWAZULU-NATAL FILM COMMISSION

(Registration number M3/15/32 (834/15)) Annual Financial Statements for the year ended 31 March 2021

Notes to the Financial Statements (continued)

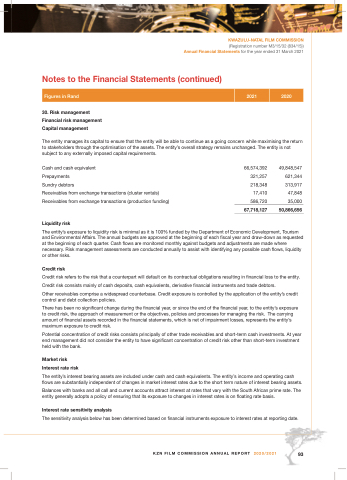

30. Risk management Financial risk management Capital management

The entity manages its capital to ensure that the entity will be able to continue as a going concern while maximising the return to stakeholders through the optimisation of the assets. The entity’s overall strategy remains unchanged. The entity is not subject to any externally imposed capital requirements.

Sundry debtors

Receivables from exchange transactions (cluster rentals) Receivables from exchange transactions (production funding)

Liquidity risk

Figures in Rand

2021

2020

Cash and cash equivalent 66,574,392 Prepayments 321,257

49,848,547 621,344 313,917 47,848 586,720 35,000

218,348 17,410

67,718,127

50,866,656

The entity’s exposure to liquidity risk is minimal as it is 100% funded by the Department of Economic Development, Tourism and Environmental Affairs. The annual budgets are approved at the beginning of each fiscal year and draw-down as requested at the beginning of each quarter. Cash flows are monitored monthly against budgets and adjustments are made where necessary. Risk management assessments are conducted annually to assist with identifying any possible cash flows, liquidity or other risks.

Credit risk

Credit risk refers to the risk that a counterpart will default on its contractual obligations resulting in financial loss to the entity. Credit risk consists mainly of cash deposits, cash equivalents, derivative financial instruments and trade debtors.

Other receivables comprise a widespread counterbase. Credit exposure is controlled by the application of the entity’s credit control and debt collection policies.

There has been no significant change during the financial year, or since the end of the financial year, to the entity’s exposure to credit risk, the approach of measurement or the objectives, policies and processes for managing the risk. The carrying amount of financial assets recorded in the financial statements, which is net of impairment losses, represents the entity’s maximum exposure to credit risk.

Potential concentration of credit risks consists principally of other trade receivables and short-term cash investments. At year end management did not consider the entity to have significant concentration of credit risk other than short-term investment held with the bank.

Market risk

Interest rate risk

The entity’s interest bearing assets are included under cash and cash equivalents. The entity’s income and operating cash flows are substantially independent of changes in market interest rates due to the short term nature of interest bearing assets.

Balances with banks and all call and current accounts attract interest at rates that vary with the South African prime rate. The entity generally adopts a policy of ensuring that its exposure to changes in interest rates is on floating rate basis.

Interest rate sensitivity analysis

The sensitivity analysis below has been determined based on financial instruments exposure to interest rates at reporting date.

KZN FILM COMMISSION ANNUAL REPORT 2020/2021

93