Page 4 - Quick Equity Release Guide 2020

P. 4

If you decide Equity Release is right for you, one of our advisors will work with you to find the right policy based on the wide range of plans available in the market and your individual circumstances.

We are totally independent specialists which means we can access products from all the major lenders. We offer a free consultation to help you find the best policy, meaning there is no pressure to take out Equity Release.

To be eligible for Equity Release you need to meet the following criteria:

● Be 55 years old or over (The youngest homeowner needs to be over 55)

● Own you home (This can be with a mortgage or previous loans against the property, but these must be paid off with the money you receive)

● Property value over £70,000

Many people are involved when making the decision to get Equity Release and we always recommend people discuss the options with their family and friends who can be great at offering advice when making important decisions. But professional advice is also important, and that’s why your Retirement Solutions financial advisor will really get to know you and your situation to help you find the right product.

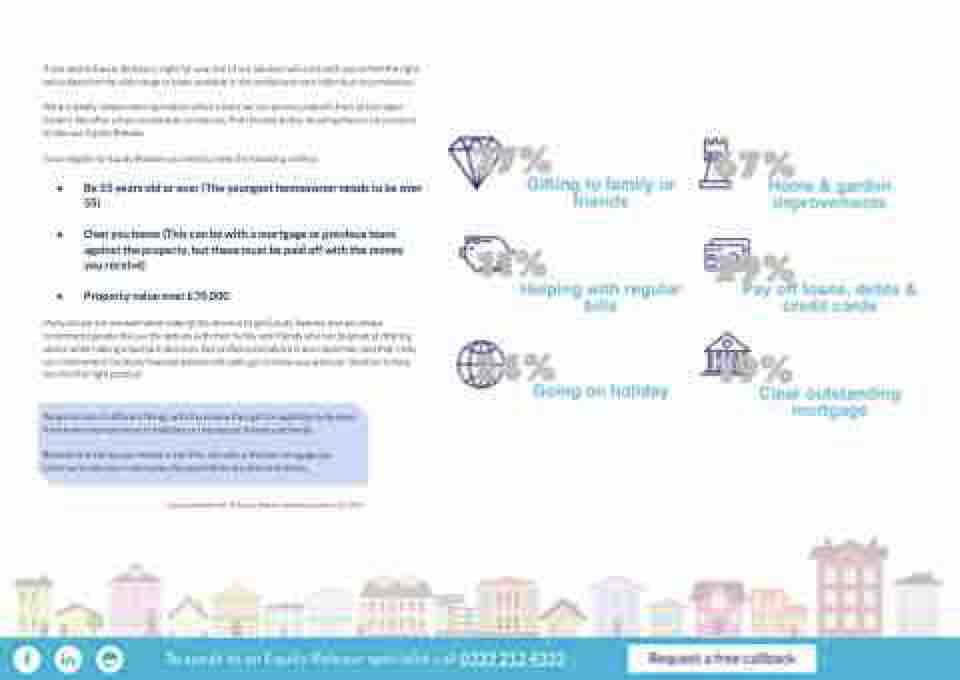

People do lots of different things with the money they get through Equity Release; from home improvements to holidays or helping out friends and family.

Because the money you release is tax free, and with a lifetime mortgage you continue to own your own home, the possibilities are almost limitless.

Data provided from UK Equity Release marketing monitor Q1 2019