Page 15 - New Guide | Draft | 3.24.21

P. 15

Avoid The Mistakes

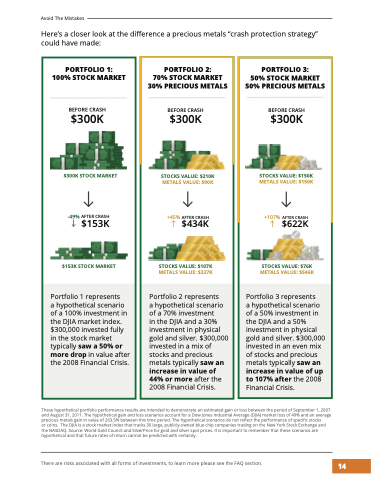

Here’s a closer look at the difference a precious metals “crash protection strategy” could have made:

PORTFOLIO 1: 100% STOCK MARKET

BEFORE CRASH

$300K

$300K STOCK MARKET

-49% AFTER CRASH $153K

$153K STOCK MARKET

PORTFOLIO 2: 70% STOCK MARKET 30% PRECIOUS METALS

BEFORE CRASH

$300K

PORTFOLIO 3: 50% STOCK MARKET 50% PRECIOUS METALS

BEFORE CRASH $300K

STOCKS VALUE: $150K

METALS VALUE: $150K

+107% AFTER CRASH $622K

STOCKS VALUE: $76K

METALS VALUE: $546K

STOCKS VALUE: $210K

METALS VALUE: $90K

+45% AFTER CRASH $434K

STOCKS VALUE: $107K

METALS VALUE: $327K

Portfolio 1 represents

a hypothetical scenario of a 100% investment in the DJIA market index. $300,000 invested fully in the stock market typically saw a 50% or more drop in value after the 2008 Financial Crisis.

Portfolio 2 represents

a hypothetical scenario of a 70% investment

in the DJIA and a 30% investment in physical gold and silver. $300,000 invested in a mix of stocks and precious metals typically saw an increase in value of 44% or more after the 2008 Financial Crisis.

Portfolio 3 represents

a hypothetical scenario of a 50% investment in the DJIA and a 50% investment in physical gold and silver. $300,000 invested in an even mix of stocks and precious metals typically saw an increase in value of up to 107% after the 2008 Financial Crisis.

These hypothetical portfolio performance results are intended to demonstrate an estimated gain or loss between the period of September 1, 2007 and August 31, 2011. The hypothetical gain and loss scenarios account for a Dow Jones Industrial Average (DJIA) market loss of 49% and an average precious metals gain in value of 263.5% between this time period. The hypothetical scenarios do not reflect the performance of specific stocks

or coins. The DJIA is a stock market index that tracks 30 large, publicly-owned blue chip companies trading on the New York Stock Exchange and the NASDAQ. Source: World Gold Council and SilverPrice for gold and silver spot prices. It is important to remember that these scenarios are hypothetical and that future rates of return cannot be predicted with certainty.

There are risks associated with all forms of investments, to learn more please see the FAQ section.

14