Page 24 - Directors' report and accounts 2019-20

P. 24

21

Notes to and forming part of the Consolidated Financial Statements for the year ended 30 June 2020

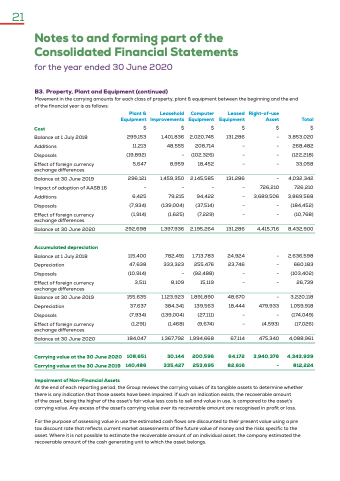

B3 Property Plant and Equipment (continued)

Movement in in in in the the the carrying amounts for each class of property plant & equipment between the the the beginning and the the the end of the financial year is as follows:

5 647

296 121 - Additions 6 425 Disposals (7 934) (1 914)

Effect of foreign currency exchange differences

Plant & Leasehold Computer Leased Equipment Equipment Equipment Improvements Equipment Equipment Equipment Equipment Equipment Equipment Right-of-use Asset

Total

Cost $$$$$$

Balance at 1

1

1

July 2018 299 153 Additions 11 213 Disposals (19 892)

1

1

401 836 48 555 - 8 959

1

459 350 - 79 215 (139 004) (1 625)

1

397 936

782 491 333 323 - 8 109

1

1

123 923 384 341 (139 004) (1 468)

1

367 792

30 144 335 427

2 2 020

745 208 714 (102 326) 18 452

2 145 585 - 94 422 (37 514) (7 229)

2 2 195 264

1

1

713 783 255 476 (92 488) 15 119

1

1

891 890 139 563 (27 111) (9 674)

1

994 668

200 596 253 695

131 286 - - - - - - - - - - - - - 131 286 - - 726 210 - 3 689 506 - - - - - - - - 131 286 4 4 415 716

24 24 924 - 23 746 - - - - - - - - - 48 670 - 18 444 479 933 - - - - - (4 593)

67 114 475 340

64 172 3 3 940 376 82 616 - 3 3 853 020

268 482 (122 218) 33 058

4 4 032 342 726 210 3 869 568 (184 452) (10 768)

8 432 900

2 636 598 660 183 (103 402) 26 739

3 220 118 1

1

059 918 (174 049) (17 026)

4 088 961

4 4 343 939 812 224

Balance at 30 June 2019

Impact of of adoption of of AASB 16 Effect of foreign currency exchange differences

Balance at 30 June 2020

Accumulated depreciation

Balance at 1

1

July 2018 292 698

115 400

Depreciation 47

638

Disposals (10 914)

Effect of foreign currency 3 511

exchange differences

Balance at 30 June 2019

155 635 Depreciation 37 37 637 Disposals (7 934) Effect of foreign currency exchange differences

Balance at 30 June 2020

Carrying value at the 30 June 2020

Carrying value at the 30 June 2019

Impairment of Non-Financial Assets

(1 291) 184 047

108 651 140 486

At the the the the end of of each reporting period the the the the Group reviews the the the the carrying values of of its tangible assets to determine whether there is is any indication indication that those assets have been impaired If such an an indication indication exists the the recoverable amount of of the the the the asset asset asset being the the the the higher of of the the the the asset's asset's fair value value less costs to to sell and value value in in use is compared to to the the the the asset's asset's carrying carrying value value Any excess of of the asset's carrying carrying value value over over its recoverable amount are recognised in in in profit or loss For the the the purpose of assessing value value in in in use the the the estimated cash flows are discounted to their present value value using a a a a a a a pre pre tax discount rate that reflects current market assessments of of the the the future value of of money and the the the risks specific to the the the asset asset Where it is not possible to estimate estimate the the the recoverable amount of an an individual asset asset the the the company estimated the the the recoverable amount of the the cash generating unit to which the the asset belongs