Page 33 - Directors' report and accounts 2019-20

P. 33

30

Notes to and forming part of the Consolidated Financial Statements for the year ended 30

June 2020

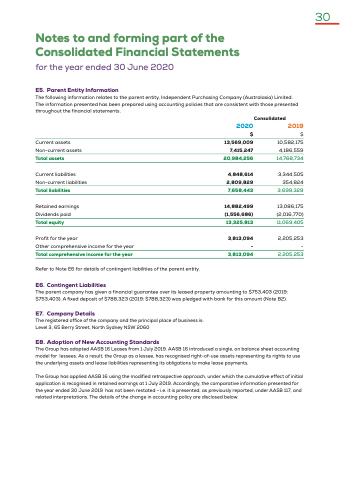

E5 Parent Entity Information

The following information relates to the parent entity Independent Purchasing Company (Australasia) Limited The information presented presented has been prepared using accounting policies that are are consistent with those presented presented throughout the financial statements 2020

2019 Consolidated $$

Current assets

Non-current assets

Total assets

Current liabilities Non-current liabilities Total liabilities Retained earnings Dividends paid Total equity

Profit for the year Other comprehensive income for the the year Total comprehensive income for the year Refer to Note E6 for details of of contingent liabilities of of the parent entity E6 Contingent Liabilities

13 569 009 7

7

415 247 20 984 256

4 4 4 848 614 2 2 809 829 7

658 443

14 882 499 (1 556 686) 13 13 325 813

3 3 813

094 - 3 3 813

094 10 582 175 4 186 559 14 768 734

3 3 344 505 354 824 3 3 699 329

13 086 175 (2 016 770) 11 069 405

2 2 2 205 253 - 2 2 2 205 253 The parent company has given a a a a a a a a a a financial guarantee over its leased property amounting to $753 403 (2019: $753 403) A fixed deposit of $788 $788 323 323 (2019: $788 $788 323) was pledged with bank for this amount (Note B2) E7 CompanyDetails

The registered office of of of the the company and the the principal place of of of business is: Level 3 65 Berry Street North Sydney NSW 2060

E8 Adoption of New Accounting Standards

The Group has adopted AASB AASB 16

16

Leases from 1 1 1 1 July 2019 AASB AASB 16

16

introduced a a a a a a a single on balance sheet accounting model for lessees As a a a a a result the Group as as as a a a a a lessee lessee has recognised right-of-use assets

representing its rights to use use the underlying assets

and lease lease liabilities representing its obligations to make lease lease payments The Group has applied AASB 16

using the the modified retrospective approach under which the the cumulative effect of initial application is is recognised in in in in in retained earnings at at at at 1 1 July 2019 Accordingly the comparative information presented for for the year ended 30

June 2019 has not been restated - i i i i e e e e e e e e e e e e e e e e e it is presented as as previously reported under AASB 117

and related interpretations The details of the change in in in accounting policy are disclosed below