Page 51 - 2018 Annual Report

P. 51

Table of Contents

available cash and borrowings under the revolving credit facility at variable interest rates. The acquisition prices and the results of operations for the acquired entities are not material in relation to the Company's consolidated financial statements.

Holdback Liabilities for Acquisitions

Acquisition holdback payments of approximately $2,592, $283, $415 and $75 will be made in fiscal 2019, 2020, 2021, and 2024, respectively. The related liabilities for these payments are recorded in the consolidated balance sheets in other current liabilities for the amounts due in fiscal year 2019 and other liabilities for the amounts due in fiscal years 2020 through 2024.

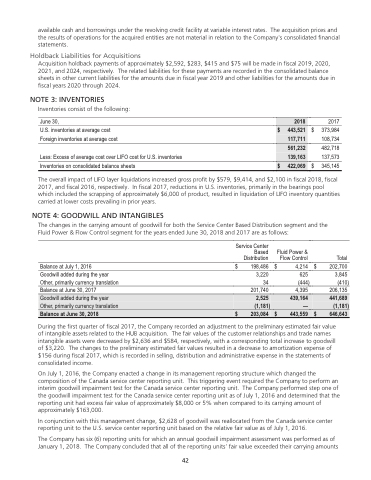

NOTE 3: INVENTORIES

Inventories consist of the following:

June 30,

U.S. inventories at average cost Foreign inventories at average cost

Less: Excess of average cost over LIFO cost for U.S. inventories Inventories on consolidated balance sheets

2017 $ 373,984 108,734 482,718 137,573 $ 345,145

2018

$ 443,521 117,711

561,232 139,163

$ 422,069

The overall impact of LIFO layer liquidations increased gross profit by $579, $9,414, and $2,100 in fiscal 2018, fiscal 2017, and fiscal 2016, respectively. In fiscal 2017, reductions in U.S. inventories, primarily in the bearings pool which included the scrapping of approximately $6,000 of product, resulted in liquidation of LIFO inventory quantities carried at lower costs prevailing in prior years.

NOTE 4: GOODWILL AND INTANGIBLES

The changes in the carrying amount of goodwill for both the Service Center Based Distribution segment and the Fluid Power & Flow Control segment for the years ended June 30, 2018 and 2017 are as follows:

Balance at July 1, 2016 $ Goodwill added during the year

Other, primarily currency translation

Balance at June 30, 2017

198,486 $ 3,220

34 201,740

4,214 $ 625

(444) 4,395

Service Center Based Distribution

Fluid Power & Flow Control

Total 202,700 3,845

(410) 206,135

Goodwill added during the year 2,525

439,164 —

441,689 (1,181)

Other, primarily currency translation (1,181)

Balance at June 30, 2018 $ 203,084

$ 443,559

$ 646,643

During the first quarter of fiscal 2017, the Company recorded an adjustment to the preliminary estimated fair value of intangible assets related to the HUB acquisition. The fair values of the customer relationships and trade names intangible assets were decreased by $2,636 and $584, respectively, with a corresponding total increase to goodwill of $3,220. The changes to the preliminary estimated fair values resulted in a decrease to amortization expense of $156 during fiscal 2017, which is recorded in selling, distribution and administrative expense in the statements of consolidated income.

On July 1, 2016, the Company enacted a change in its management reporting structure which changed the composition of the Canada service center reporting unit. This triggering event required the Company to perform an interim goodwill impairment test for the Canada service center reporting unit. The Company performed step one of the goodwill impairment test for the Canada service center reporting unit as of July 1, 2016 and determined that the reporting unit had excess fair value of approximately $8,000 or 5% when compared to its carrying amount of approximately $163,000.

In conjunction with this management change, $2,628 of goodwill was reallocated from the Canada service center reporting unit to the U.S. service center reporting unit based on the relative fair value as of July 1, 2016.

The Company has six (6) reporting units for which an annual goodwill impairment assessment was performed as of January 1, 2018. The Company concluded that all of the reporting units’ fair value exceeded their carrying amounts

42

42