Page 13 - Legacy Brochure

P. 13

Gifts to the Malvernian Society are exempt from UK Inheritance Tax (IHT) and Capital Gains Tax. The value of a legacy gift is deducted from the total value of your estate before Inheritance Tax is calculated.

Married couples are allowed to pass their possessions and assets to each other tax-free.

If your estate passes to non-exempt beneficiaries (such as your children), IHT is due at 40% on the balance of your estate above your tax-free allowance. This allowance, also

known as the nil-rate band, is currently £325,000 but you may be entitled to additional tax allowances if you have previously been widowed or leave a residential property to direct descendants. It is possible to reduce the rate of IHT to 36% if at least 10% of your estate is left to charity.

Legacies do not attract Gift Aid.

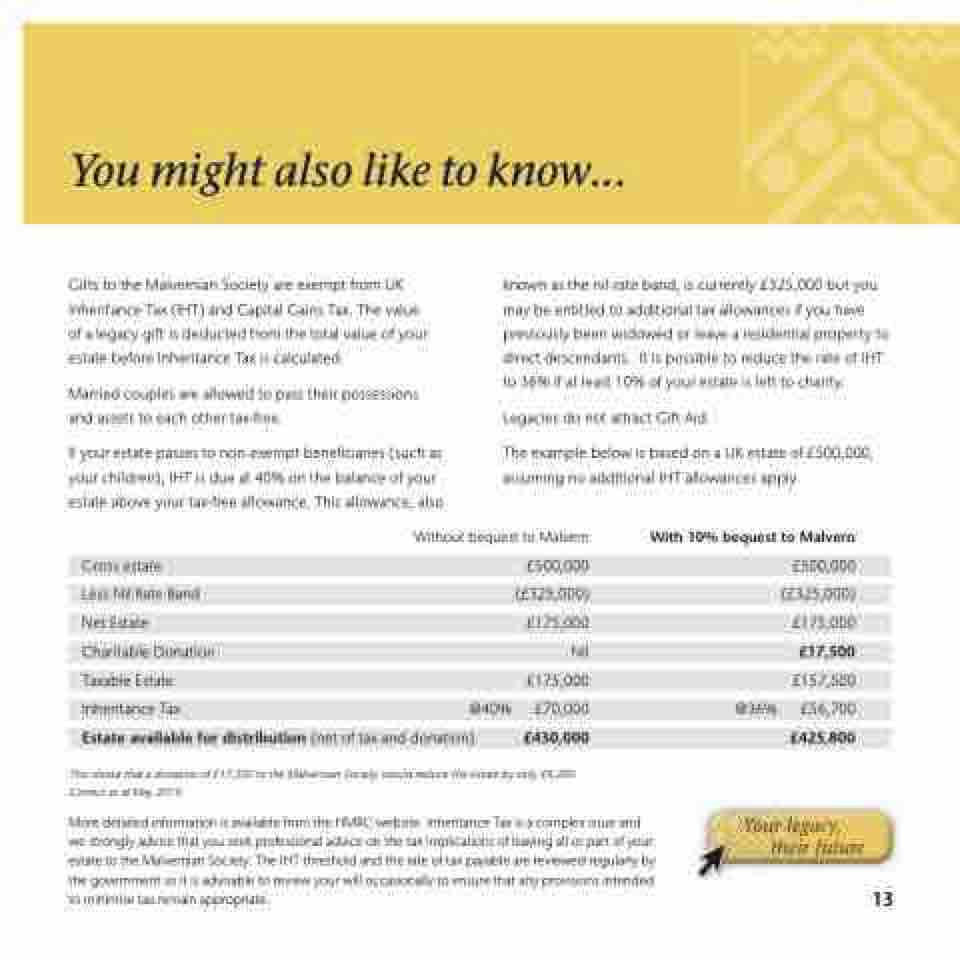

The example below is based on a UK estate of £500,000, assuming no additional IHT allowances apply.

Gross estate

Less Nil Rate Band

Net Estate

Charitable Donation

Taxable Estate

Inheritance Tax

Estate available for distribution (net of tax and donation)

@36%

£500,000 (£325,000) £175,000 £17,500 £157,500 £56,700 £425,800

Without bequest to Malvern £500,000 (£325,000) £175,000 Nil £175,000 £70,000 £430,000

With 10% bequest to Malvern

@40%

This shows that a donation of £17,500 to the Malvernian Society would reduce the estate by only £4,200. Correct as at May 2019.

More detailed information is available from the HMRC website. Inheritance Tax is a complex issue and we strongly advise that you seek professional advice on the tax implications of leaving all or part of your estate to the Malvernian Society. The IHT threshold and the rate of tax payable are reviewed regularly by the government so it is advisable to review your will occasionally to ensure that any provisions intended to minimise tax remain appropriate.

13

Your legacy, their future

You might also like to know...