Page 2 - Wealth Transfer Playbook

P. 2

The Great Wealth Transfer

And How Agents Can Help Clients Navigate Through It

What’s the Great Wealth Transfer?

The baby boomer generation is aging and over the next few decades, will be passing on. Dubbed The Great Wealth Transfer, it’s estimated that as much as $68 trillion in wealth will be passed to heirs and charity during this time frame.

Who is your ideal wealth transfer client?

Before entering a discussion with clients regarding wealth transfer, first, determine if you have a good understanding of their goals. Discussing how someone wants to spend their money in retirement, or even how they want it allocated once they’ve passed on, is an extremely personal subject. The ideal client for this conversation would be somebody with which you have already established a relationship based on rapport and trust. At a minimum, you should have a completed Futurity First Planning Guide in the client’s file.

The Futurity First Planning Guide was designed to help you holistically understand your clients’ unique situation, goals, needs and aspirations. It covers in-depth, the four areas of our compass: Asset Protection, Income Protection, Healthcare Planning and Legacy Planning. Some questions in the guide may be good indicators that your client needs help planning how they would like to allocate their assets in the future.

One example of a good indicator question can be found on page five of the Planning Guide, under the “Legacy Planning” section. Here it asks, what is the “Purpose of your current life insurance?” followed by a space to add notes.

A second

example of a

good indicator

question can

be found on

page six, under the

“Asset Protection” section: “What do you see yourself using your savings/ investments for?” followed

by, “What are your goals for savings/investments?”

The answers that your clients

provide to the above-mentioned questions (and others) will help you uncover potential opportunities where you may be able to help them.

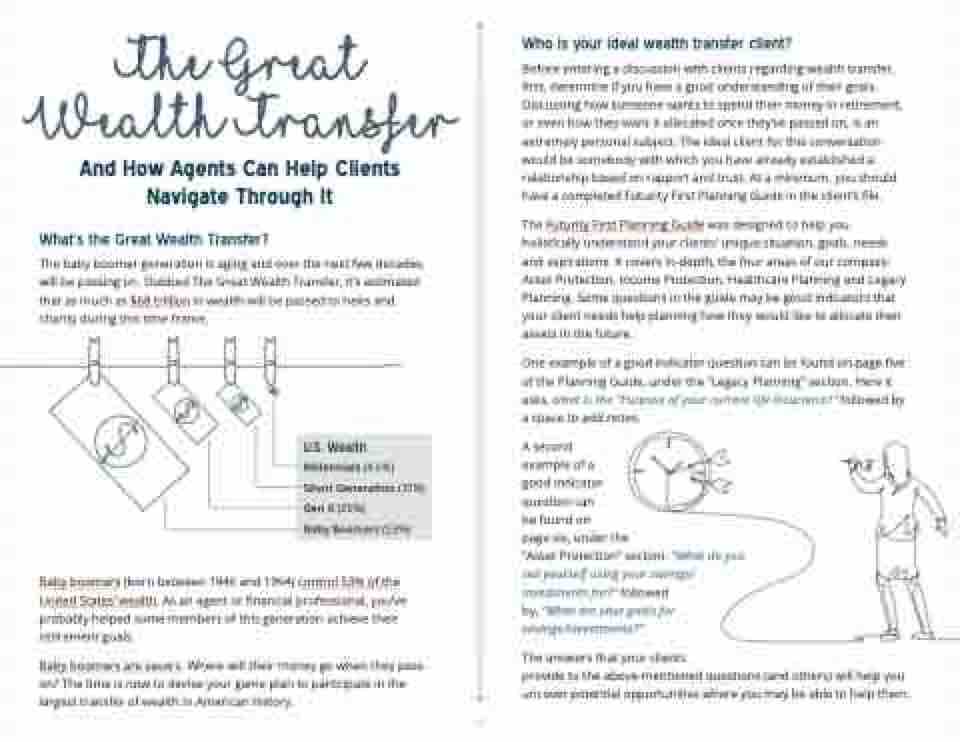

U.S. Wealth

Millennials (4.6%) Silent Generation (17%) Gen X (25%)

Baby Boomers (53%)

Baby boomers (born between 1946 and 1964) control 53% of the United States’ wealth. As an agent or financial professional, you’ve probably helped some members of this generation achieve their retirement goals.

Baby boomers are savers. Where will their money go when they pass on? The time is now to devise your game plan to participate in the largest transfer of wealth in American history.

-2-