Page 55 - Demo

P. 55

In brief: what central banks do

Central banks are lenders of last resort.

Most readers have never experienced the circumstance that triggers the need for the SARB to play this role. Even in instances when it did, this was done in relative secrecy for the reason central banks exist: to prevent panic.

According to De Kock (1929, p 17), a central bank “... should not attempt to call in loans or restrict credit directly in times of emergency. On the contrary, it should be prepared to lend freely to the commercial banks and others in order to relieve the temporary strain.”

In addition, De Kock (1929, pp 17−18) notes: “In connection with its attempt to steady the money market and keep it free from panics, or at any rate minimise the fluctuations and disturbances in the economic life of a country, it is essential for a Central Bank that it should also be either the sole or the principal banker to the Government.”

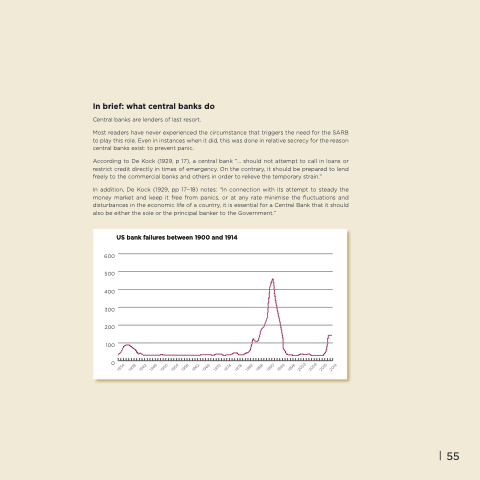

US bank failures between 1900 and 1914

600 500 400 300 200

100 0

Sources: PA and SARB

55

1934 1938

1942 1946

1950 1954

1958 1962

1966 1970

1974 1978

1982 1986

1990 1994

1998 2002

2006 2010

2014