Page 66 - Demo

P. 66

The gold standard debate seized all corners of the Union, none more so than the farming community, whose “desperate plight” took centre stage (Rand Daily Mail, 23 February 1932). The source of this “plight” could be traced back to the “... serious disequilibrium between export prices (excluding gold), on the one hand, and import prices and the prices of South African goods and services, on the other,” notes De Kock (1954, p 146).

The Hertzog administration’s supposed obduracy on the gold standard may be explained by the fact that: “Economic conditions in South Africa were, nevertheless, relatively favourable compared with those in many other countries. This was due to the peculiar role played by gold mining in the economic structure of the Union,” according to De Kock (1954, p 146).

On 22 February 1932, the Select Committee on the Gold Standard was appointed. The Select Committee concluded its work in May 1932, when a report of its work was released. Two commercial banks gave evidence to the Committee to the effect that an estimated £13−£14 million had left the Union between September 1931 and February 1932. Initial speculation had set the projections between £20 million and £30 million. The Committee’s own estimate, based on the “examination of bank deposits and exchange transactions”, was between £9 million and £10 million. (De Kock, 1954, p 147).

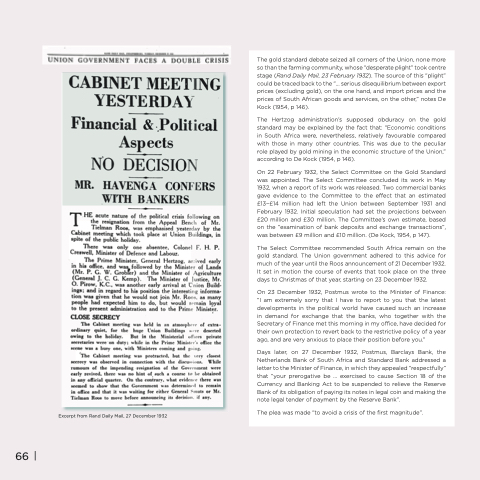

The Select Committee recommended South Africa remain on the gold standard. The Union government adhered to this advice for much of the year until the Roos announcement of 21 December 1932. It set in motion the course of events that took place on the three days to Christmas of that year, starting on 23 December 1932.

On 23 December 1932, Postmus wrote to the Minister of Finance: “I am extremely sorry that I have to report to you that the latest developments in the political world have caused such an increase in demand for exchange that the banks, who together with the Secretary of Finance met this morning in my office, have decided for their own protection to revert back to the restrictive policy of a year ago, and are very anxious to place their position before you.”

Days later, on 27 December 1932, Postmus, Barclays Bank, the Netherlands Bank of South Africa and Standard Bank addressed a letter to the Minister of Finance, in which they appealed “respectfully” that “your prerogative be ... exercised to cause Section 18 of the Currency and Banking Act to be suspended to relieve the Reserve Bank of its obligation of paying its notes in legal coin and making the note legal tender of payment by the Reserve Bank”.

The plea was made “to avoid a crisis of the first magnitude”.

66

Excerpt from Rand Daily Mail, 27 December 1932