Page 9 - HCSC2019EG

P. 9

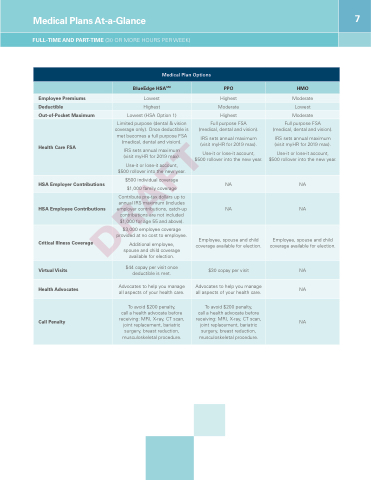

Medical Plans At-a-Glance

7

FULL-TIME AND PART-TIME (30 OR MORE HOURS PER WEEK)

Medical Plan Options

BlueEdge HSASM

PPO

HMO

Employee Premiums

Lowest

Highest

Moderate

Deductible

Highest

Moderate

Lowest

Out-of-Pocket Maximum

Lowest (HSA Option 1)

Highest

Moderate

Health Care FSA

Limited purpose (dental & vision coverage only). Once deductible is met becomes a full purpose FSA (medical, dental and vision).

IRS sets annual maximum (visit myHR for 2019 max).

Use-it or lose-it account, $500 rollover into the new year.

Full purpose FSA (medical, dental and vision).

IRS sets annual maximum (visit myHR for 2019 max).

Use-it or lose-it account, $500 rollover into the new year.

Full purpose FSA (medical, dental and vision).

IRS sets annual maximum (visit myHR for 2019 max).

Use-it or lose-it account, $500 rollover into the new year.

HSA Employer Contributions

$500 individual coverage $1,000 family coverage

NA

NA

HSA Employee Contributions

Contribute pre-tax dollars up to

annual IRS maximum (includes employer contributions, catch-up contributions are not included $1,000 for age 55 and above).

NA

NA

Critical Illness Coverage

$3,000 employee coverage provided at no cost to employee.

Additional employee, spouse and child coverage available for election.

Employee, spouse and child coverage available for election.

Employee, spouse and child coverage available for election.

Virtual Visits

$44 copay per visit once deductible is met.

$30 copay per visit

NA

Health Advocates

Advocates to help you manage all aspects of your health care.

Advocates to help you manage all aspects of your health care.

NA

Call Penalty

To avoid $200 penalty,

call a health advocate before receiving: MRI, X-ray, CT scan, joint replacement, bariatric surgery, breast reduction, musculoskeletal procedure.

To avoid $200 penalty,

call a health advocate before receiving: MRI, X-ray, CT scan, joint replacement, bariatric surgery, breast reduction, musculoskeletal procedure.

NA