Page 1 - Private Wealth Specialist Growth Moderate PDF Factsheet

P. 1

MyNorth Managed Portfolios

PRIVATE WEALTH SPECIALIST GROWTH MODERATE

Monthly Update for Month Ending September 2024

Returns as at 30 September 2024

Investment objective

3 6

Aims to deliver returns above the benchmark Since 1 Month Months Months 1 Year 3 Years 5 Years

peer group over a rolling 3-to-5-year period. inception* (%) (%) (%) (%)

(%) (%)

Key information Total return¹ 5.79 1.45 4.48 4.57 14.05 - -

Income 3.14 0.17 0.68 1.20 3.26 - -

Code NTH0237

Growth 2.65 1.28 3.80 3.37 10.79 - -

Manager name Genium Investment Benchmark² 5.47 1.22 4.21 3.70 13.81 - -

Partners Pty Ltd

* Since inception returns commence from the month end of the portfolio's launch.

Inception date 24 March 2022

Benchmark Morningstar Australian Asset allocation

Multi-Sector Balanced

Average Category

Asset class Diversified

Number of underlying assets 33

Minimum investment horizon 5 years

Portfolio income Default - Paid to Platform

Cash

Management fees and costs '0.43%

Performance fee '0.01%

Estimated net transaction costs '0.12%

Estimated buy/sell spread '0.06%/0.07% as at 30 September 2024

Risk band/label 4/Medium

Minimum investment amount $25,000

About the manager

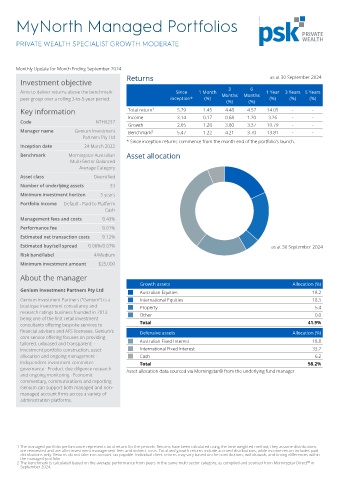

Growth assets Allocation (%)

Genium Investment Partners Pty Ltd Australian Equities 18.2

Genium Investment Partners ("Genium") is a International Equities 18.3

boutique investment consultancy and Property 5.4

research ratings business founded in 2013 Other 0.0

being one of the first retail investment

consultants offering bespoke services to Total 41.9%

financial advisers and AFS licensees. Genium’s Defensive assets Allocation (%)

core service offering focuses on providing

tailored, unbiased and transparent: · Australian Fixed Interest 18.8

Investment portfolio construction, asset International Fixed Interest 33.2

allocation and ongoing management · Cash 6.2

Independent investment committee Total 58.2%

governance · Product due diligence research Asset allocation data sourced via Morningstar® from the underlying fund manager.

and ongoing monitoring · Economic

commentary, communications and reporting

Genium can support both managed and non-

managed account firms across a variety of

administration platforms.

1 The managed portfolio performance represents total return for the periods. Returns have been calculated using the time-weighted method, they assume distributions

are reinvested and are after investment management fees and indirect costs. Total and growth returns include accrued distributions, while income return includes paid

distributions only. Returns do not take into account tax payable. Individual client returns may vary based on the contributions, withdrawals, and timing differences within

the managed portfolio

2 The benchmark is calculated based on the average performance from peers in the same multi sector category, as compiled and sourced from Morningstar Direct™ in

September 2024.