Page 1 - Specialist Income Moderate_March 2023

P. 1

MyNorth Managed Portfolios

PRIVATE WEALTH SPECIALIST INCOME MODERATE

Quarterly update for quarter 31 March 2023

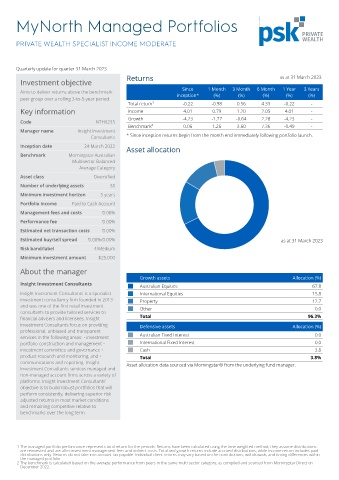

Returns as at 31 March 2023

Investment objective

Since 1 Month 3 Month 6 Month 1 Year 3 Years

Aims to deliver returns above the benchmark inception* (%) (%) (%) (%) (%)

peer group over a rolling 3-to-5-year period.

Total return¹ -0.22 -0.98 0.56 4.33 -0.22 -

Key information Income 4.01 0.79 1.20 2.05 4.01 -

Growth -4.23 -1.77 -0.64 2.28 -4.23 -

Code NTH0235

Benchmark² 0.06 1.26 3.60 7.36 -0.49 -

Manager name Insight Investment

Consultants * Since inception returns begin from the month end immediately following portfolio launch.

Inception date 24 March 2022 Asset allocation

Benchmark Morningstar Australian

Multisector Balanced

Average Category

Asset class Diversified

Number of underlying assets 38

Minimum investment horizon 5 years

Portfolio income Paid to Cash Account

Management fees and costs '0.06%

Performance fee '0.00%

Estimated net transaction costs '0.00%

Estimated buy/sell spread '0.00%/0.00% as at 31 March 2023

Risk band/label 4/Medium

Minimum investment amount $25,000

About the manager

Growth assets Allocation (%)

Insight Investment Consultants Australian Equities 67.8

Insight Investment Consultants is a specialist International Equities 15.8

investment consultancy firm founded in 2013 Property 12.7

and was one of the first retail investment Other 0.0

consultants to provide tailored services to

financial advisers and licensees. Insight Total 96.3%

Investment Consultants focus on providing Defensive assets Allocation (%)

professional, unbiased and transparent

services in the following areas: • investment Australian Fixed Interest 0.0

portfolio construction and management • International Fixed Interest 0.0

investment committee and governance • Cash 3.8

product research and monitoring, and • Total 3.8%

communications and reporting. Insight Asset allocation data sourced via Morningstar® from the underlying fund manager.

Investment Consultants services managed and

non-managed account firms across a variety of

platforms. Insight Investment Consultants’

objective is to build robust portfolios that will

perform consistently, delivering superior risk

adjusted returns in most market conditions

and remaining competitive relative to

benchmarks over the long term.

1 The managed portfolio performance represents total return for the periods. Returns have been calculated using the time-weighted method, they assume distributions

are reinvested and are after investment management fees and indirect costs. Total and growth returns include accrued distributions, while income return includes paid

distributions only. Returns do not take into account tax payable. Individual client returns may vary based on the contributions, withdrawals, and timing differences within

the managed portfolio

2 The benchmark is calculated based on the average performance from peers in the same multi sector category, as compiled and sourced from Morningstar Direct on

December 2022.