Page 108 - January 2022

P. 108

FINANCIAL PLANNING

ARE CRYPTOCURRENCIES HERE TO STAY?

Cryptocurrencies are beginning to have a significant weight in many people’s portfolio. At this point, most American adults have a general

idea what crypto is. In case you’re not aware, cryptocurrency is a virtual or digital currency that only exists electronically. The idea is to fix the problems with traditional currency by putting all

of the power in the owner’s hands. There are now over 10,000 different cryptocurrencies that can be traded on exchanges such as Coinbase, Binance, and Kraken. If you haven’t heard of these, don’t worry, you’re not alone. Cryptocurrency has become a very popular trend, and new age investors want in on the action. According to studies, roughly 16% of American adults have invested in cryptocurrencies. Millennials make up 44.3% of that total. The question that continues to rise is: Are these cryptocurrencies here to stay? In this article, I’m going to give my personal opinion on these virtual currencies and explain why I think some are here to stay, but will face a massive correction in valuation.

SUCCESS STORIES

I don’t want to give the impression that I’m totally against these currencies. There is a big difference in using crypto as a utility for exchange and buying crypto as an investment. I have heard ofsomepeoplewhoinvestedinBitcoinoranother currency and made a handsome profit, at least

on paper. Bitcoin is perhaps the most popular

and well-known virtual currency. The average annualized return for Bitcoin has been roughly 409% per year since 2009, when it first came

into existence. This is not a normal return for a sustainable investment. For those individuals who

have enjoyed massive gains, I will tip my cap to you, but will also mention just how dangerous this market has become. Gains like this are not normal and completely speculative. Many people avoid the stock market because they consider it to be gambling. The stock market has been around for over a century and therefore we have a pretty good idea as to what a normal return for capital assetsshouldbe. I’vealsodonemyfairshareof research on virtual and digital currencies. The success stories do not give enough reason to make crypto a large part of your retirement plan. I consider investing in cryptocurrencies to be a form of gambling. The returns are completely bizarre. Remember, there is always a trade-off. These currencies come with extreme levels of risk.

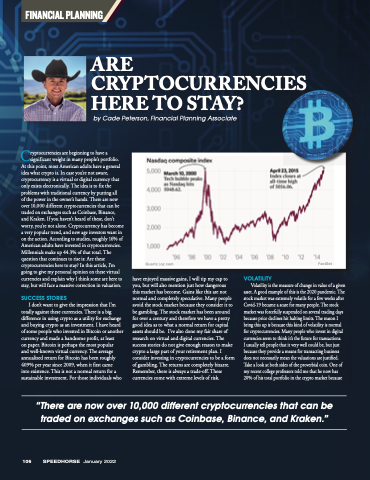

VOLATILITY

Volatility is the measure of change in value of a given asset. A good example of this is the 2020 pandemic. The stock market was extremely volatile for a few weeks after Covid-19 became a scare for many people. The stock market was forcefully suspended on several trading days because price declines hit halting limits. The reason I bring this up is because this kind of volatility is normal forcryptocurrencies.Manypeoplewhoinvestindigital currencies seem to think it’s the future for transactions.

I usually tell people that it very well could be, but just because they provide a means for transacting business does not necessarily mean the valuations are justified. Take a look at both sides of the proverbial coin. One of my recent college professors told me that he now has 20% of his total portfolio in the crypto market because

by Cade Peterson, Financial Planning Associate

Quartz | qz.com FactSet

“There are now over 10,000 different cryptocurrencies that can be traded on exchanges such as Coinbase, Binance, and Kraken.”

106 SPEEDHORSE January 2022