Page 177 - September 2023

P. 177

FINANCIAL PLANNING

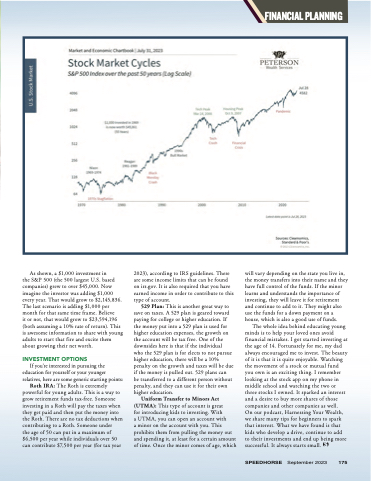

As shown, a $1,000 investment in

the S&P 500 (the 500 largest U.S. based companies) grew to over $45,000. Now imagine the investor was adding $1,000 every year. That would grow to $2,145,836. The last scenario is adding $1,000 per month for that same time frame. Believe

it or not, that would grow to $23,594,196 (both assuming a 10% rate of return). This

2023), according to IRS guidelines. There are some income limits that can be found on irs.gov. It is also required that you have earned income in order to contribute to this type of account.

529 Plan: This is another great way to save on taxes. A 529 plan is geared toward paying for college or higher education. If the money put into a 529 plan is used for

will vary depending on the state you live in, the money transfers into their name and they have full control of the funds. If the minor learns and understands the importance of investing, they will leave it for retirement and continue to add to it. They might also use the funds for a down payment on a house, which is also a good use of funds.

The whole idea behind educating young

is awesome information to share with young adults to start that fire and excite them about growing their net worth.

INVESTMENT OPTIONS

If you’re interested in pursuing the education for yourself or your younger relatives, here are some generic starting points:

Roth IRA: The Roth is extremely powerful for young adults. This is a way to grow retirement funds tax-free. Someone investing in a Roth will pay the taxes when they get paid and then put the money into the Roth. There are no tax deductions when contributing to a Roth. Someone under

the age of 50 can put in a maximum of $6,500 per year while individuals over 50 can contribute $7,500 per year (for tax year

higher education expenses, the growth on the account will be tax free. One of the downsides here is that if the individual

who the 529 plan is for elects to not pursue higher education, there will be a 10% penalty on the growth and taxes will be due if the money is pulled out. 529 plans can

be transferred to a different person without penalty, and they can use it for their own higher education.

Uniform Transfer to Minors Act (UTMA): This type of account is great

for introducing kids to investing. With

a UTMA, you can open an account with

a minor on the account with you. This prohibits them from pulling the money out and spending it, at least for a certain amount of time. Once the minor comes of age, which

minds is to help your loved ones avoid financial mistakes. I got started investing at the age of 14. Fortunately for me, my dad always encouraged me to invest. The beauty of it is that it is quite enjoyable. Watching the movement of a stock or mutual fund you own is an exciting thing. I remember looking at the stock app on my phone in middle school and watching the two or three stocks I owned. It sparked an interest and a desire to buy more shares of those companies and other companies as well.

On our podcast, Harnessing Your Wealth, we share many tips for beginners to spark that interest. What we have found is that kids who develop a drive, continue to add to their investments and end up being more successful. It always starts small.

SPEEDHORSE September 2023 175