Page 26 - ITI VC Guide V10

P. 26

26

Equity Funding Guide

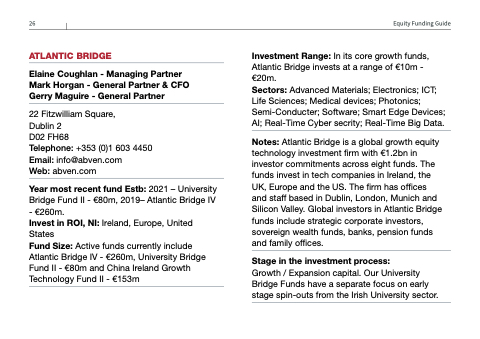

ATLANTIC BRIDGE

Elaine Coughlan - Managing Partner Mark Horgan - General Partner & CFO Gerry Maguire - General Partner

22 Fitzwilliam Square,

Dublin 2

D02 FH68

Telephone: +353 (0)1 603 4450 Email: info@abven.com

Web: abven.com

Year most recent fund Estb: 2021 – University Bridge Fund II - €80m, 2019– Atlantic Bridge IV - €260m.

Invest in ROI, NI: Ireland, Europe, United States

Fund Size: Active funds currently include Atlantic Bridge IV - €260m, University Bridge Fund II - €80m and China Ireland Growth Technology Fund II - €153m

Investment Range: In its core growth funds, Atlantic Bridge invests at a range of €10m - €20m.

Sectors: Advanced Materials; Electronics; ICT; Life Sciences; Medical devices; Photonics; Semi-Conducter; Software; Smart Edge Devices; AI; Real-Time Cyber secrity; Real-Time Big Data.

Notes: Atlantic Bridge is a global growth equity technology investment firm with €1.2bn in investor commitments across eight funds. The funds invest in tech companies in Ireland, the UK, Europe and the US. The firm has offices and staff based in Dublin, London, Munich and Silicon Valley. Global investors in Atlantic Bridge funds include strategic corporate investors, sovereign wealth funds, banks, pension funds and family offices.

Stage in the investment process:

Growth / Expansion capital. Our University Bridge Funds have a separate focus on early stage spin-outs from the Irish University sector.