Page 35 - ITI VC Guide V10

P. 35

35

Equity Funding Guide

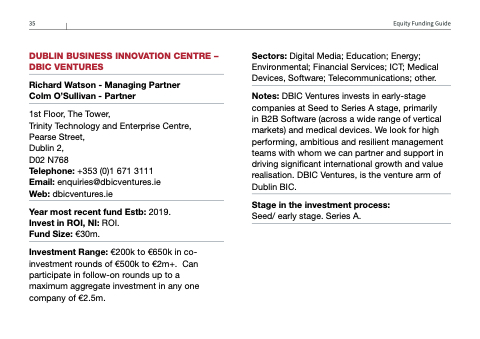

DUBLIN BUSINESS INNOVATION CENTRE – DBIC VENTURES

Richard Watson - Managing Partner Colm O’Sullivan - Partner

1st Floor, The Tower,

Trinity Technology and Enterprise Centre, Pearse Street,

Dublin 2,

D02 N768

Telephone: +353 (0)1 671 3111

Email: enquiries@dbicventures.ie

Web: dbicventures.ie

Year most recent fund Estb: 2019. Invest in ROI, NI: ROI.

Fund Size: €30m.

Investment Range: €200k to €650k in co- investment rounds of €500k to €2m+. Can participate in follow-on rounds up to a maximum aggregate investment in any one company of €2.5m.

Sectors: Digital Media; Education; Energy; Environmental; Financial Services; ICT; Medical Devices, Software; Telecommunications; other.

Notes: DBIC Ventures invests in early-stage companies at Seed to Series A stage, primarily in B2B Software (across a wide range of vertical markets) and medical devices. We look for high performing, ambitious and resilient management teams with whom we can partner and support in driving significant international growth and value realisation. DBIC Ventures, is the venture arm of Dublin BIC.

Stage in the investment process:

Seed/ early stage. Series A.