Page 38 - ITI VC Guide V10

P. 38

38

Equity Funding Guide

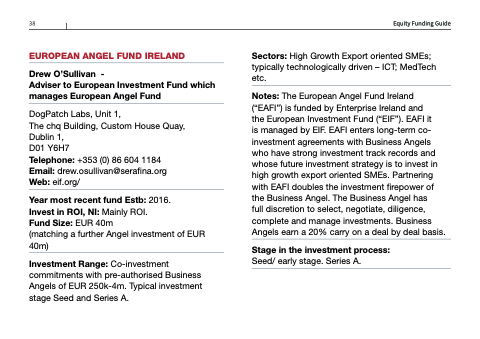

EUROPEAN ANGEL FUND IRELAND

Drew O’Sullivan -

Adviser to European Investment Fund which manages European Angel Fund

DogPatch Labs, Unit 1,

The chq Building, Custom House Quay, Dublin 1,

D01 Y6H7

Telephone: +353 (0) 86 604 1184 Email: drew.osullivan@serafina.org Web: eif.org/

Year most recent fund Estb: 2016.

Invest in ROI, NI: Mainly ROI.

Fund Size: EUR 40m

(matching a further Angel investment of EUR 40m)

Investment Range: Co-investment commitments with pre-authorised Business Angels of EUR 250k-4m. Typical investment stage Seed and Series A.

Sectors: High Growth Export oriented SMEs; typically technologically driven – ICT; MedTech etc.

Notes: The European Angel Fund Ireland (“EAFI”) is funded by Enterprise Ireland and

the European Investment Fund (“EIF”). EAFI it

is managed by EIF. EAFI enters long-term co- investment agreements with Business Angels who have strong investment track records and whose future investment strategy is to invest in high growth export oriented SMEs. Partnering with EAFI doubles the investment firepower of the Business Angel. The Business Angel has

full discretion to select, negotiate, diligence, complete and manage investments. Business Angels earn a 20% carry on a deal by deal basis.

Stage in the investment process:

Seed/ early stage. Series A.