Page 44 - ITI VC Guide V10

P. 44

44

Equity Funding Guide

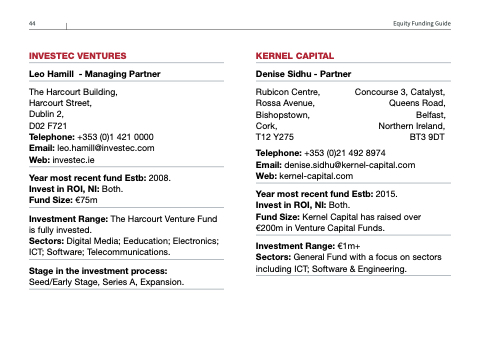

INVESTEC VENTURES

Leo Hamill - Managing Partner

The Harcourt Building, Harcourt Street, Dublin 2,

D02 F721

Telephone: +353 (0)1 421 0000 Email: leo.hamill@investec.com Web: investec.ie

Year most recent fund Estb: 2008. Invest in ROI, NI: Both.

Fund Size: €75m

Investment Range: The Harcourt Venture Fund is fully invested.

Sectors: Digital Media; Eeducation; Electronics; ICT; Software; Telecommunications.

Stage in the investment process:

Seed/Early Stage, Series A, Expansion.

KERNEL CAPITAL

Denise Sidhu - Partner

Rubicon Centre,

Rossa Avenue,

Bishopstown, Belfast, Cork, Northern Ireland,

BT3 9DT Email: denise.sidhu@kernel-capital.com

T12 Y275

Telephone: +353 (0)21 492 8974 Web: kernel-capital.com

Concourse 3, Catalyst, Queens Road,

Year most recent fund Estb: 2015. Invest in ROI, NI: Both.

Fund Size: Kernel Capital has raised over €200m in Venture Capital Funds.

Investment Range: €1m+

Sectors: General Fund with a focus on sectors including ICT; Software & Engineering.