Page 54 - ITI VC Guide V10

P. 54

54

Equity Funding Guide

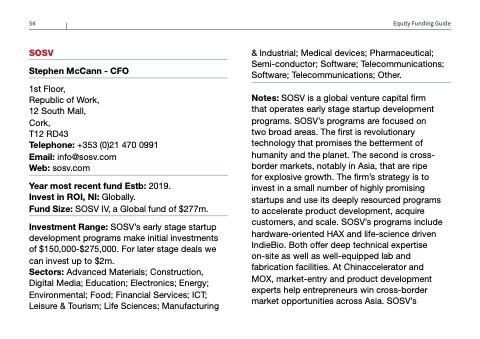

SOSV

Stephen McCann - CFO

1st Floor,

Republic of Work,

12 South Mall,

Cork,

T12 RD43

Telephone: +353 (0)21 470 0991 Email: info@sosv.com

Web: sosv.com

Year most recent fund Estb: 2019.

Invest in ROI, NI: Globally.

Fund Size: SOSV IV, a Global fund of $277m.

Investment Range: SOSV’s early stage startup development programs make initial investments of $150,000-$275,000. For later stage deals we can invest up to $2m.

Sectors: Advanced Materials; Construction, Digital Media; Education; Electronics; Energy; Environmental; Food; Financial Services; ICT; Leisure & Tourism; Life Sciences; Manufacturing

& Industrial; Medical devices; Pharmaceutical; Semi-conductor; Software; Telecommunications; Software; Telecommunications; Other.

Notes: SOSV is a global venture capital firm that operates early stage startup development programs. SOSV’s programs are focused on two broad areas. The first is revolutionary technology that promises the betterment of humanity and the planet. The second is cross- border markets, notably in Asia, that are ripe

for explosive growth. The firm’s strategy is to invest in a small number of highly promising startups and use its deeply resourced programs to accelerate product development, acquire customers, and scale. SOSV’s programs include hardware-oriented HAX and life-science driven IndieBio. Both offer deep technical expertise on-site as well as well-equipped lab and fabrication facilities. At Chinaccelerator and MOX, market-entry and product development experts help entrepreneurs win cross-border market opportunities across Asia. SOSV’s