Page 59 - ITI VC Guide V10

P. 59

59

Equity Funding Guide

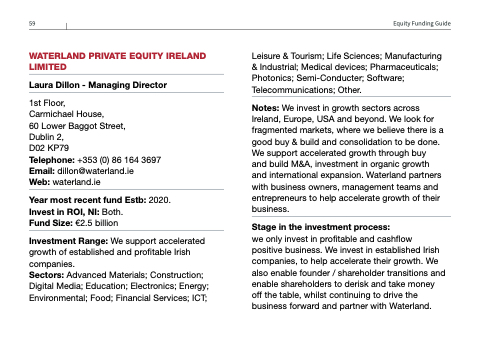

WATERLAND PRIVATE EQUITY IRELAND LIMITED

Laura Dillon - Managing Director

1st Floor,

Carmichael House,

60 Lower Baggot Street,

Dublin 2,

D02 KP79

Telephone: +353 (0) 86 164 3697 Email: dillon@waterland.ie

Web: waterland.ie

Year most recent fund Estb: 2020. Invest in ROI, NI: Both.

Fund Size: €2.5 billion

Investment Range: We support accelerated growth of established and profitable Irish companies.

Sectors: Advanced Materials; Construction; Digital Media; Education; Electronics; Energy; Environmental; Food; Financial Services; ICT;

Leisure & Tourism; Life Sciences; Manufacturing & Industrial; Medical devices; Pharmaceuticals; Photonics; Semi-Conducter; Software; Telecommunications; Other.

Notes: We invest in growth sectors across Ireland, Europe, USA and beyond. We look for fragmented markets, where we believe there is a good buy & build and consolidation to be done. We support accelerated growth through buy and build M&A, investment in organic growth and international expansion. Waterland partners with business owners, management teams and entrepreneurs to help accelerate growth of their business.

Stage in the investment process:

we only invest in profitable and cashflow

positive business. We invest in established Irish companies, to help accelerate their growth. We also enable founder / shareholder transitions and enable shareholders to derisk and take money off the table, whilst continuing to drive the business forward and partner with Waterland.