Page 14 - ITI VC Guide

P. 14

14

Equity Funding Guide

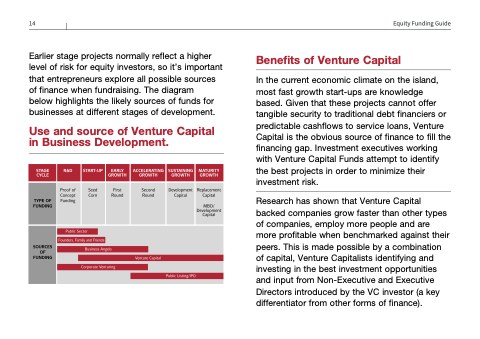

Earlier stage projects normally reflect a higher level of risk for equity investors, so it’s important that entrepreneurs explore all possible sources of finance when fundraising. The diagram

below highlights the likely sources of funds for businesses at different stages of development.

Use and source of Venture Capital in Business Development.

Benefits of Venture Capital

In the current economic climate on the island, most fast growth start-ups are knowledge based. Given that these projects cannot offer tangible security to traditional debt financiers or predictable cashflows to service loans, Venture Capital is the obvious source of finance to fill the financing gap. Investment executives working with Venture Capital Funds attempt to identify the best projects in order to minimize their investment risk.

Research has shown that Venture Capital backed companies grow faster than other types of companies, employ more people and are more profitable when benchmarked against their peers. This is made possible by a combination of capital, Venture Capitalists identifying and investing in the best investment opportunities and input from Non-Executive and Executive Directors introduced by the VC investor (a key differentiator from other forms of finance).