Page 29 - ITI VC Guide

P. 29

29

Equity Funding Guide

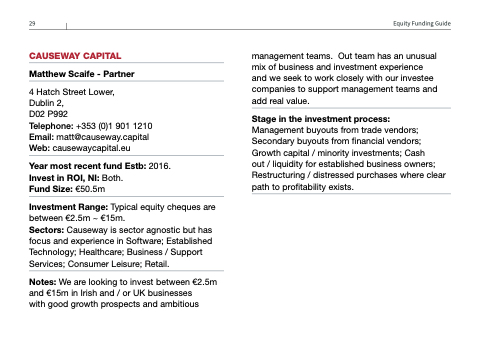

CAUSEWAY CAPITAL

Matthew Scaife - Partner

4 Hatch Street Lower,

Dublin 2,

D02 P992

Telephone: +353 (0)1 901 1210 Email: matt@causeway.capital Web: causewaycapital.eu

Year most recent fund Estb: 2016. Invest in ROI, NI: Both.

Fund Size: €50.5m

Investment Range: Typical equity cheques are between €2.5m ~ €15m.

Sectors: Causeway is sector agnostic but has focus and experience in Software; Established Technology; Healthcare; Business / Support Services; Consumer Leisure; Retail.

Notes: We are looking to invest between €2.5m and €15m in Irish and / or UK businesses

with good growth prospects and ambitious

management teams. Out team has an unusual mix of business and investment experience and we seek to work closely with our investee companies to support management teams and add real value.

Stage in the investment process:

Management buyouts from trade vendors; Secondary buyouts from financial vendors; Growth capital / minority investments; Cash

out / liquidity for established business owners; Restructuring / distressed purchases where clear path to profitability exists.