Page 58 - Demo

P. 58

ISHINE CLOUD LIMITED

(A company limited by guarantee)

NOTES OF FINANCIAL ACTIVITIES

March 31, 2019

4 FINANCIAL INSTRUMENTS, FINANCIAL RISKS AND CAPITAL MANAGEMENT

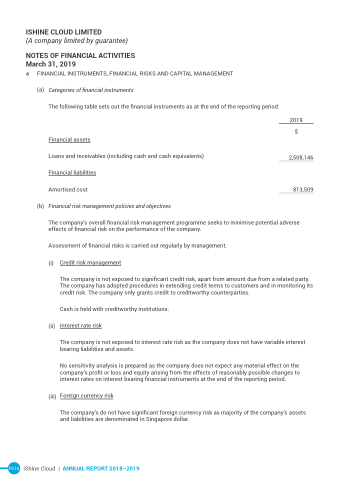

(a) Categories of nancial instruments

The following table sets out the nancial instruments as at the end of the reporting period:

Financial assets

Loans and receivables (including cash and cash equivalents) Financial liabilities

Amortised cost

2019 $

2,508,146

813,509

(b) Financial risk management policies and objectives

The company’s overall nancial risk management programme seeks to minimise potential adverse

effects of nancial risk on the performance of the company. Assessment of nancial risks is carried out regularly by management.

(i) Credit risk management

The company is not exposed to signi cant credit risk, apart from amount due from a related party. The company has adopted procedures in extending credit terms to customers and in monitoring its credit risk. The company only grants credit to creditworthy counterparties.

Cash is held with creditworthy institutions.

(ii) Interest rate risk

The company is not exposed to interest rate risk as the company does not have variable interest bearing liabilities and assets.

No sensitivity analysis is prepared as the company does not expect any material effect on the company’s pro t or loss and equity arising from the effects of reasonably possible changes to interest rates on interest bearing nancial instruments at the end of the reporting period.

(iii) Foreign currency risk

The company’s do not have signi cant foreign currency risk as majority of the company’s assets

and liabilities are denominated in Singapore dollar.

FS16 iShine Cloud | ANNUAL REPORT 2018–2019