Page 62 - Commercial - Underwriting Mandates & Guidelines Binder

P. 62

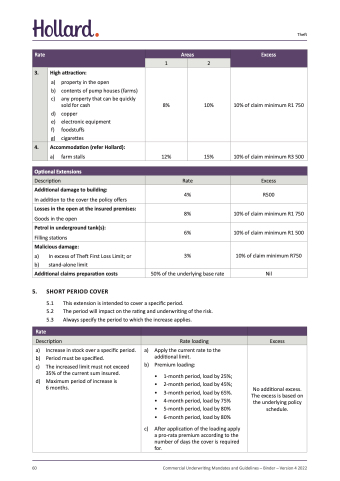

Theft

Rate

Areas

Excess

1

2

3.

High attraction:

a) property in the open

b) contents of pump houses (farms)

c) any property that can be quickly sold for cash

d) copper

e) electronic equipment

f) foodstuffs

g) cigarettes

8%

10%

10% of claim minimum R1 750

4.

Accommodation (refer Hollard):

a) farm stalls 12%

Additional damage to building:

In addition to the cover the policy offers

Losses in the open at the insured premises:

Goods in the open

Petrol in underground tank(s):

Filling stations

Additional claims preparation costs

5. SHORT PERIOD COVER

15%

10% of claim minimum R3 500

R500

10% of claim minimum R1 750

10% of claim minimum R1 500

Nil

Optional Extensions

Description

Rate

Excess

5.1 5.2 5.3

This extension is intended to cover a specific period.

The period will impact on the rating and underwriting of the risk. Always specify the period to which the increase applies.

4%

8%

6%

Malicious damage:

a) In excess of Theft First Loss Limit; or

b) stand-alone limit

3%

10% of claim minimum R750

50% of the underlying base rate

Rate

Description

Rate loading

Excess

a) Increase in stock over a specific period.

b) Period must be specified.

c) The increased limit must not exceed 35% of the current sum insured.

d) Maximum period of increase is 6 months.

a) Apply the current rate to the additional limit.

b) Premium loading:

• 1-month period, load by 25%;

• 2-month period, load by 45%;

• 3-month period, load by 65%.

• 4-month period, load by 75%

• 5-month period, load by 80%

• 6-month period, load by 80%

c) After application of the loading apply a pro-rata premium according to the number of days the cover is required for.

No additional excess. The excess is based on the underlying policy schedule.

60

Commercial Underwriting Mandates and Guidelines – Binder – Version 4 2022