Page 87 - Commercial - Underwriting Mandates & Guidelines Binder

P. 87

Combined Liability (Claims-made Basis)

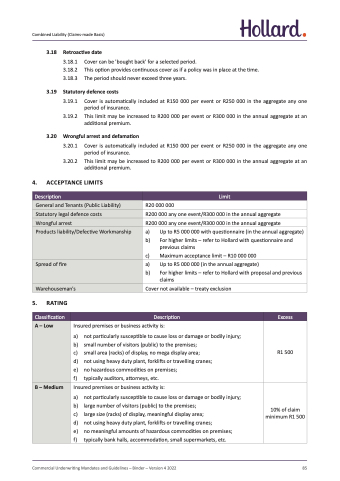

3.18 Retroactive date

3.18.1 Cover can be 'bought back' for a selected period.

3.18.2 This option provides continuous cover as if a policy was in place at the time.

3.18.3 The period should never exceed three years.

3.19 Statutory defence costs

3.19.1 Cover is automatically included at R150 000 per event or R250 000 in the aggregate any one period of insurance.

3.19.2 This limit may be increased to R200 000 per event or R300 000 in the annual aggregate at an additional premium.

3.20 Wrongful arrest and defamation

3.20.1 Cover is automatically included at R150 000 per event or R250 000 in the aggregate any one period of insurance.

3.20.2 This limit may be increased to R200 000 per event or R300 000 in the annual aggregate at an additional premium.

4. ACCEPTANCE LIMITS

Description

General and Tenants (Public Liability)

Limit

R20 000 000

R200 000 any one event/R300 000 in the annual aggregate R200 000 any one event/R300 000 in the annual aggregate

a) Up to R5 000 000 (in the annual aggregate)

b) For higher limits – refer to Hollard with proposal and previous claims

Cover not available – treaty exclusion

Statutory legal defence costs

Wrongful arrest

Products liability/Defective Workmanship

a) Up to R5 000 000 with questionnaire (in the annual aggregate)

b) For higher limits – refer to Hollard with questionnaire and previous claims

c) Maximum acceptance limit – R10 000 000

Spread of fire

Warehouseman's

5. RATING

Classification

Description

Excess

A – Low

Insured premises or business activity is:

a) not particularly susceptible to cause loss or damage or bodily injury;

b) small number of visitors (public) to the premises;

c) small area (racks) of display, no mega display area;

d) not using heavy duty plant, forklifts or travelling cranes;

e) no hazardous commodities on premises;

f) typically auditors, attorneys, etc.

R1 500

B – Medium

Insured premises or business activity is:

a) not particularly susceptible to cause loss or damage or bodily injury;

b) large number of visitors (public) to the premises;

c) large size (racks) of display, meaningful display area;

d) not using heavy duty plant, forklifts or travelling cranes;

e) no meaningful amounts of hazardous commodities on premises;

f) typically bank halls, accommodation, small supermarkets, etc.

10% of claim minimum R1 500

Commercial Underwriting Mandates and Guidelines – Binder – Version 4 2022 85