Page 31 - AreaNewsletters "May 2020" issue

P. 31

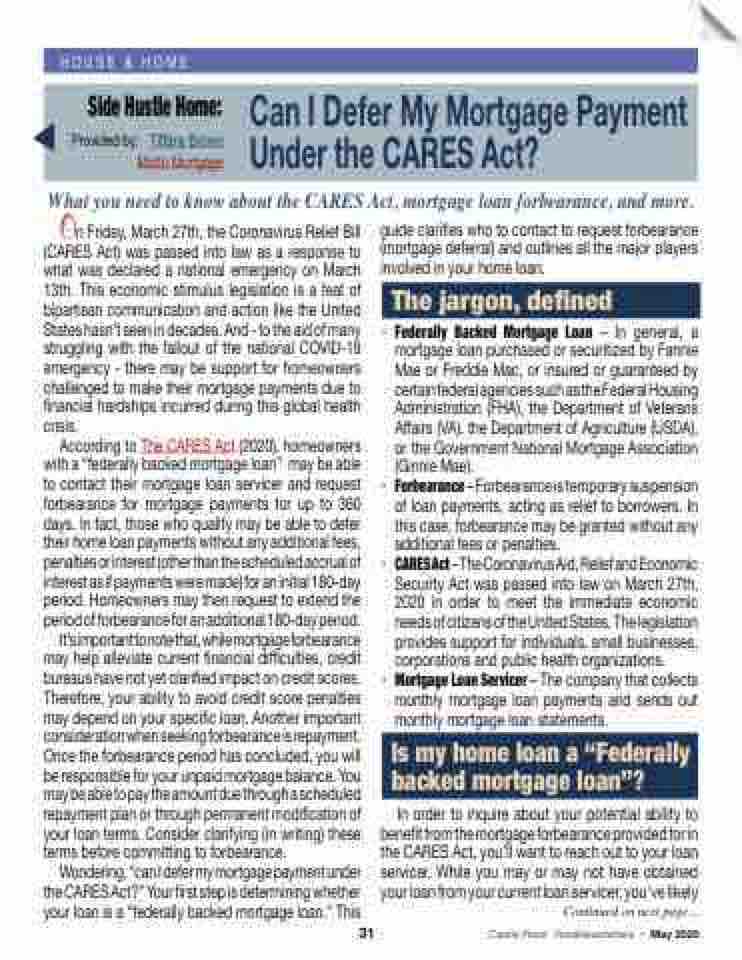

H O U S E & H O ME

Side Hustle Home:

Provided by: Ti any Brown Motto Mortgage

Can I Defer My Mortgage Payment Under the CARES Act?

What you need to know about the CARES Act, mortgage loan forbearance, and more.

On Friday, March 27th, the Coronavirus Relief Bill (CARES Act) was passed into law as a response to what was declared a national emergency on March 13th. This economic stimulus legislation is a feat of bipartisan communication and action like the United States hasn’t seen in decades. And - to the aid of many struggling with the fallout of the national COVID-19 emergency - there may be support for homeowners challenged to make their mortgage payments due to nancial hardships incurred during this global health crisis.

According to The CARES Act (2020), homeowners witha“federallybackedmortgageloan” maybeable to contact their mortgage loan servicer and request forbearance for mortgage payments for up to 360 days. In fact, those who qualify may be able to defer their home loan payments without any additional fees, penalties or interest (other than the scheduled accrual of interest as if payments were made) for an initial 180-day period. Homeowners may then request to extend the period of forbearance for an additional 180-day period.

It’simportanttonotethat,whilemortgageforbearance may help alleviate current nancial di culties, credit bureaus have not yet clari ed impact on credit scores. Therefore, your ability to avoid credit score penalties may depend on your speci c loan. Another important considerationwhenseekingforbearanceisrepayment. Once the forbearance period has concluded, you will be responsible for your unpaid mortgage balance. You may be able to pay the amount due through a scheduled repayment plan or through permanent modi cation of your loan terms. Consider clarifying (in writing) these terms before committing to forbearance.

Wondering, “can I defer my mortgage payment under the CARES Act?” Your rst step is determining whether your loan is a “federally backed mortgage loan.” This

guide clari es who to contact to request forbearance (mortgage deferral) and outlines all the major players involved in your home loan.

The jargon, de ned

• Federally Backed Mortgage Loan – In general, a mortgage loan purchased or securitized by Fannie Mae or Freddie Mac, or insured or guaranteed by certain federal agencies such as the Federal Housing Administration (FHA), the Department of Veterans A airs (VA), the Department of Agriculture (USDA), or the Government National Mortgage Association (Ginnie Mae).

• Forbearance – Forbearance is temporary suspension of loan payments, acting as relief to borrowers. In this case, forbearance may be granted without any additional fees or penalties.

• CARESAct–TheCoronavirusAid,ReliefandEconomic Security Act was passed into law on March 27th, 2020 in order to meet the immediate economic needs of citizens of the United States. The legislation provides support for individuals, small businesses, corporations and public health organizations.

• Mortgage Loan Servicer – The company that collects monthly mortgage loan payments and sends out monthly mortgage loan statements.

In order to inquire about your potential ability to bene t from the mortgage forbearance provided for in the CARES Act, you’ll want to reach out to your loan servicer. While you may or may not have obtained your loan from your current loan servicer, you’ve likely

Continued on next page...

31

Castle Rock “AreaNewsletters • May 2020

Is my home loan a “Federally backed mortgage loan”?