Page 1 - AAG060_Items Needed Checklist

P. 1

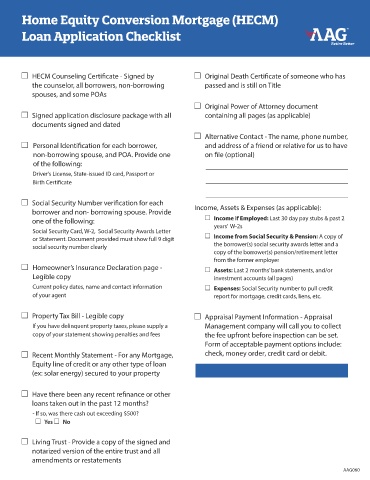

Home Equity Conversion Mortgage (HECM)

Loan Application Checklist

c HECM Counseling Certificate - Signed by c Original Death Certificate of someone who has

the counselor, all borrowers, non-borrowing passed and is still on Title

spouses, and some POAs

c Original Power of Attorney document

c Signed application disclosure package with all containing all pages (as applicable)

documents signed and dated

c Alternative Contact - The name, phone number,

c Personal Identification for each borrower, and address of a friend or relative for us to have

non-borrowing spouse, and POA. Provide one on file (optional)

of the following:

Driver’s License, State-issued ID card, Passport or

Birth Certificate

c Social Security Number verification for each

borrower and non- borrowing spouse. Provide Income, Assets & Expenses (as applicable):

one of the following: c Income if Employed: Last 30 day pay stubs & past 2

years’ W-2s

Social Security Card, W-2, Social Security Awards Letter c

or Statement. Document provided must show full 9 digit Income from Social Security & Pension: A copy of

social security number clearly the borrower(s) social security awards letter and a

copy of the borrower(s) pension/retirement letter

from the former employer

c Homeowner’s Insurance Declaration page - c Assets: Last 2 months’ bank statements, and/or

Legible copy investment accounts (all pages)

Current policy dates, name and contact information c Expenses: Social Security number to pull credit

of your agent report for mortgage, credit cards, liens, etc.

c Property Tax Bill - Legible copy c Appraisal Payment Information - Appraisal

If you have delinquent property taxes, please supply a Management company will call you to collect

copy of your statement showing penalties and fees the fee upfront before inspection can be set.

Form of acceptable payment options include:

c Recent Monthly Statement - For any Mortgage, check, money order, credit card or debit.

Equity line of credit or any other type of loan

(ex: solar energy) secured to your property

c Have there been any recent refinance or other

loans taken out in the past 12 months?

- If so, was there cash out exceeding $500?

c Yes c No

c Living Trust - Provide a copy of the signed and

notarized version of the entire trust and all

amendments or restatements

AAG060