Page 1 - AAG019_Ways to Use an RM

P. 1

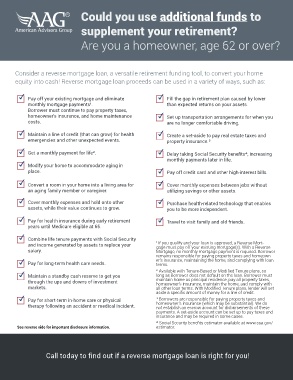

Could you use additional funds to

supplement your retirement?

Are you a homeowner, age 62 or over?

Consider a reverse mortgage loan, a versatile retirement funding tool, to convert your home

equity into cash! Reverse mortgage loan proceeds can be used in a variety of ways, such as:

3

3

c c

Pay off your existing mortgage and eliminate

Fill the gap in retirement plan caused by lower

monthly mortgage payments¹. than expected returns on your assets.

Borrower must continue to pay property taxes,

3

homeowner’s insurance, and home maintenance c

Set up transportation arrangements for when you

costs. are no longer comfortable driving.

c c

3

3

Maintain a line of credit (that can grow) for health

Create a set-aside to pay real estate taxes and

emergencies and other unexpected events. property insurance.³

3

3

c Get a monthly payment for life². c

Delay taking Social Security benefits⁴, increasing

monthly payments later in life.

c

3

Modify your home to accommodate aging in

3

place. c

Pay off credit card and other high-interest bills.

3

3

c Convert a room in your home into a living area for c

Cover monthly expenses between jobs without

an aging family member or caregiver. utilizing savings or other assets.

3

3

c c

Cover monthly expenses and hold onto other

Purchase health-related technology that enables

assets, while their value continues to grow. you to be more independent.

3

3

Pay for health insurance during early retirement

c c

Travel to visit family and old friends.

years until Medicare eligible at 65.

3

c

Combine life tenure payments with Social Security

and income generated by assets to replace your ¹ If you qualify and your loan is approved, a Reverse Mort-

gage must pay off your existing mortgage(s). With a Reverse

salary. Mortgage, no monthly mortgage payment is required. Borrower

remains responsible for paying property taxes and homeown-

3

c er’s insurance, maintaining the home, and complying with loan

Pay for long-term health care needs.

terms.

² Available with Tenure-Based or Modified Tenure plans, so

3

Maintain a standby cash reserve to get you

c long as Borrower does not default on the loan. Borrower must

through the ups and downs of investment maintain home as principal residence, pay all property taxes,

homeowner’s insurance, maintain the home, and comply with

markets. all other loan terms. With Modified Tenure plans, lender will set

aside a specific amount of money for a line of credit.

3

c ³ Borrowers are responsible for paying property taxes and

Pay for short-term in-home care or physical

homeowner’s insurance (which may be substantial). We do

therapy following an accident or medical incident. not establish an escrow account for disbursements of these

payments. A set-aside account can be set up to pay taxes and

insurance and may be required in some cases.

⁴ Social Security benefits estimator available at www.ssa.gov/

See reverse side for important disclosure information. estimator.

Call today to find out if a reverse mortgage loan is right for you!