Page 1 - AAG028_H4P Estimator Flyer

P. 1

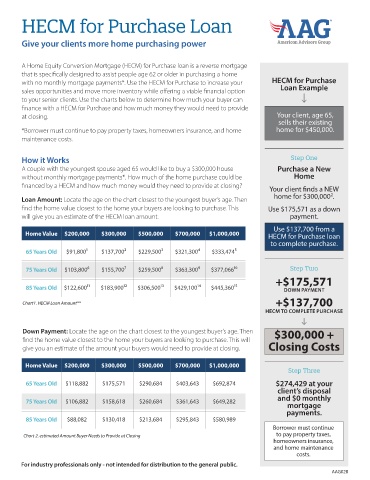

HECM for Purchase Loan

Give your clients more home purchasing power

A Home Equity Conversion Mortgage (HECM) for Purchase loan is a reverse mortgage

that is specifically designed to assist people age 62 or older in purchasing a home

with no monthly mortgage payments*. Use the HECM for Purchase to increase your HECM for Purchase

Loan Example

sales opportunities and move more inventory while offering a viable financial option

to your senior clients. Use the charts below to determine how much your buyer can

finance with a HECM for Purchase and how much money they would need to provide

at closing. Your client, age 65,

sells their existing

*Borrower must continue to pay property taxes, homeowners insurance, and home home for $450,000.

maintenance costs.

How it Works Step One

A couple with the youngest spouse aged 65 would like to buy a $300,000 house Purchase a New

without monthly mortgage payments*. How much of the home purchase could be Home

financed by a HECM and how much money would they need to provide at closing?

Your client finds a NEW

2

home for $300,000 .

Loan Amount: Locate the age on the chart closest to the youngest buyer’s age. Then

find the home value closest to the home your buyers are looking to purchase. This Use $175,571 as a down

will give you an estimate of the HECM loan amount. payment.

Use $137,700 from a

Home Value $200,000 $300,000 $500,000 $700,000 $1,000,000 HECM for Purchase loan

to complete purchase.

65 Years Old $91,800¹ $137,700² $229,500³ $321,300⁴ $333,474⁵

75 Years Old $103,800⁶ $155,700⁷ $259,500⁸ $363,300⁹ $377,066¹⁰ Step Two

+$175,571

85 Years Old $122,600¹¹ $183,900¹² $306,500¹³ $429,100¹⁴ $445,360¹⁵ DOWN PAYMENT

+$137,700

Chart1. HECM Loan Amount**

HECM TO COMPLETE PURCHASE

Down Payment: Locate the age on the chart closest to the youngest buyer’s age. Then $300,000 +

find the home value closest to the home your buyers are looking to purchase. This will

give you an estimate of the amount your buyers would need to provide at closing. Closing Costs

Home Value $200,000 $300,000 $500,000 $700,000 $1,000,000

Step Three

65 Years Old $118,882 $175,571 $290,684 $403,643 $692,874 $274,429 at your

client’s disposal

75 Years Old $106,882 $158,618 $260,684 $361,643 $649,282 and $0 monthly

mortgage

payments.

85 Years Old $88,082 $130,418 $213,684 $295,843 $580,989

Borrower must continue

Chart 2. estimated Amount Buyer Needs to Provide at Closing to pay property taxes,

homeowners insurance,

and home maintenance

costs.

For industry professionals only - not intended for distribution to the general public.

AAG028