Page 88 - BWA Annual Report 2023

P. 88

WESTERN AUSTRALIAN BASKETBALL FEDERATION (INC.)

Notes to the financial statements

for the year ended 31 December 2023

Note Note

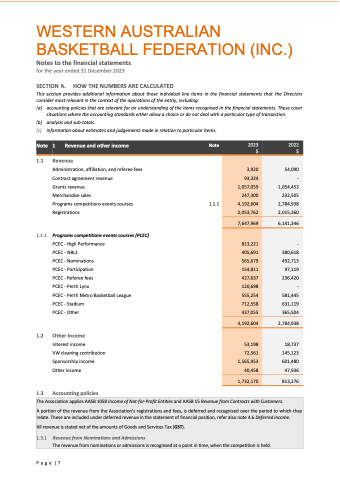

SECTION A. HOW THE NUMBERS ARE CALCULATED

This section provides additional information about those individual line items in the financial statements that the Directors consider most relevant in the context of the operations of the entity, including:

(a) accounting policies that are relevant for an understanding of the items recognised in the financial statements. These cover situations where the accounting standards either allow a choice or do not deal with a particular type of transaction.

(b) analysis and sub-totals.

(c) information about estimates and judgements made in relation to particular items.

2023 2022 $$

3,920 93,324 1,057,059 247,300 4,192,604 2,053,762

54,090 - 1,054,453 232,505 2,784,938 2,015,360

7,647,969

6,141,346

813,221 405,691 565,679 154,811 427,637 120,698 555,254 712,558 437,055

- 380,618 492,713 97,119 236,420 - 581,445 631,119 365,504

4,192,604

2,784,938

53,198

72,561 1,565,953 40,458

18,737 145,123 601,480

47,936

1,732,170

813,276

1 Revenue and other income

1.1 Revenue

Administration, affiliation, and referee fees Contract agreement revenue

Grants revenue

Merchandise sales

Programs competitions events courses Registrations

1.1.1 Programs competitions events courses (PCEC) PCEC - High Performance

PCEC - NBL1

PCEC - Nominations

PCEC - Participation

PCEC - Referee fees

PCEC - Perth Lynx

PCEC - Perth Metro Basketball League PCEC - Stadium

PCEC - Other

1.2 Other Income

Interest income

VW cleaning contribution Sponsorship income Other income

1.3 Accounting policies

1.1.1

The Association applies AASB 1058 Income of Not-for-Profit Entities and AASB 15 Revenue from Contracts with Customers.

A portion of the revenue from the Association’s registrations and fees, is deferred and recognised over the period to which they

relate. These are included under deferred revenue in the statement of financial position, refer also note 4.6 Deferred income.

All revenue is stated net of the amounts of Goods and Services Tax (GST).

1.3.1 Revenue from Nominations and Admissions

The revenue from nominations or admissions is recognised at a point in time, when the competition is held.

Page|7