Page 74 - BWA 2021 ANNUAL REPORT

P. 74

WESTERN AUSTRALIAN BASKETBALL FEDERATION INC.

Notes to the financial statements

for the year ended 31 December 2021

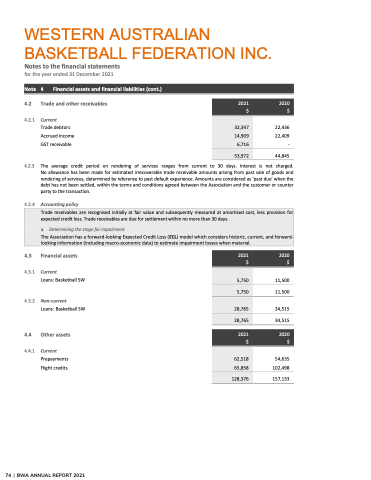

Note 4 Financial assets and financial liabilities (cont.)

4.2 Trade and other receivables

4.2.1 Current

Trade debtors

Accrued income GST receivable

22,436 22,409 -

44,845

2021 $

4.2.3 The average credit period on rendering of services ranges from current to 30 days. Interest is not charged. No allowance has been made for estimated irrecoverable trade receivable amounts arising from past sale of goods and rendering of services, determined by reference to past default experience. Amounts are considered as ‘past due’ when the debt has not been settled, within the terms and conditions agreed between the Association and the customer or counter party to the transaction.

4.2.4 Accounting policy

Trade receivables are recognised initially at fair value and subsequently measured at amortised cost, less provision for expected credit loss. Trade receivables are due for settlement within no more than 30 days.

a. Determining the stage for impairment

The Association has a forward-looking Expected Credit Loss (ECL) model which considers historic, current, and forward- looking information (including macro-economic data) to estimate impairment losses when material.

4.3 Financial assets

4.3.1 Current

Loans: Basketball SW

4.3.2 Non-current

Loans: Basketball SW

4.4 Other assets

4.4.1 Current Prepayments

Flight credits

11,500 11,500

34,515 34,515

54,635 102,498

157,133

74 | BWA ANNUAL REPORT 2021

P a g e | 74

2020 $

32,347 14,909

6,716

53,972

2021 $

2020 $

5,750

5,750

28,765

28,765

2021 $

62,518 65,858

2020 $

128,376