Page 79 - BWA Annual Report 2020 W

P. 79

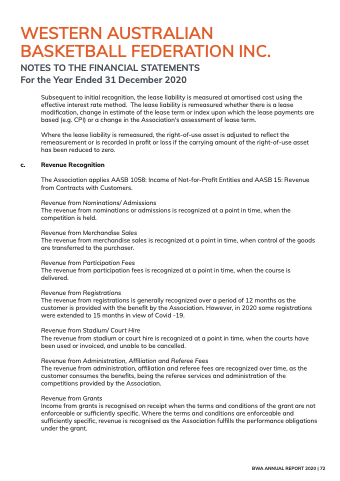

WESTERN AUSTRALIAN BASKETBALL FEDERATION INC.

NOTES TO THE FINANCIAL STATEMENTS For the Year Ended 31 December 2020

Subsequent to initial recognition, the lease liability is measured at amortised cost using the effective interest rate method. The lease liability is remeasured whether there is a lease modification, change in estimate of the lease term or index upon which the lease payments are based (e.g. CPI) or a change in the Association's assessment of lease term.

Where the lease liability is remeasured, the right-of-use asset is adjusted to reflect the remeasurement or is recorded in profit or loss if the carrying amount of the right-of-use asset has been reduced to zero.

c. Revenue Recognition

The Association applies AASB 1058: Income of Not-for-Profit Entities and AASB 15: Revenue from Contracts with Customers.

Revenue from Nominations/ Admissions

The revenue from nominations or admissions is recognized at a point in time, when the competition is held.

Revenue from Merchandise Sales

The revenue from merchandise sales is recognized at a point in time, when control of the goods are transferred to the purchaser.

Revenue from Participation Fees

The revenue from participation fees is recognized at a point in time, when the course is delivered.

Revenue from Registrations

The revenue from registrations is generally recognized over a period of 12 months as the customer is provided with the benefit by the Association. However, in 2020 some registrations were extended to 15 months in view of Covid -19.

Revenue from Stadium/ Court Hire

The revenue from stadium or court hire is recognized at a point in time, when the courts have been used or invoiced, and unable to be cancelled.

Revenue from Administration, Affiliation and Referee Fees

The revenue from administration, affiliation and referee fees are recognized over time, as the customer consumes the benefits, being the referee services and administration of the competitions provided by the Association.

Revenue from Grants

Income from grants is recognised on receipt when the terms and conditions of the grant are not enforceable or sufficiently specific. Where the terms and conditions are enforceable and sufficiently specific, revenue is recognised as the Association fulfills the performance obligations under the grant.

BWA ANNUAL REPORT 2020 | 72