Page 78 - 2022 BWA ANNUAL REPORT

P. 78

WESTERN AUSTRALIAN BASKETBALL FEDERATION INC.

Notes to the financial statements

for the year ended 31 December 2022

Note

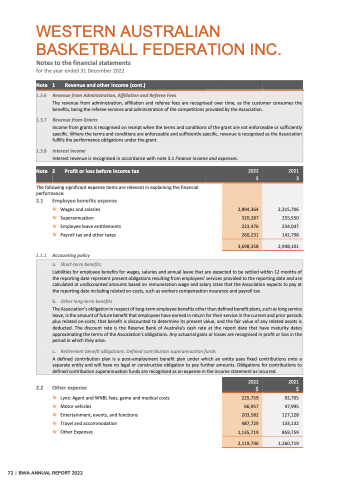

1 Revenue and other income (cont.)

1.3.6 Revenue from Administration, Affiliation and Referee Fees

The revenue from administration, affiliation and referee fees are recognised over time, as the customer consumes the benefits, being the referee services and administration of the competitions provided by the Association.

1.3.7 Revenue from Grants

Income from grants is recognised on receipt when the terms and conditions of the grant are not enforceable or sufficiently

specific. Where the terms and conditions are enforceable and sufficiently specific, revenue is recognised as the Association

fulfills the performance obligations under the grant.

1.3.8 Interest income

Interest revenue is recognised in accordance with note 3.1 Finance income and expenses.

2022 $

2021 $

2,894,364 320,287 223,476 260,231

2,315,706 255,550 234,047 142,798

3,698,358

2,948,101

Note

2.1.1 Accounting policy

2 Profit or loss before income tax

The following significant expense items are relevant in explaining the financial performance:

2.1 Employee benefits expense

Wages and salaries

Superannuation

Employee leave entitlements Payroll tax and other taxes

a. Short-term benefits

Liabilities for employee benefits for wages, salaries and annual leave that are expected to be settled within 12 months of the reporting date represent present obligations resulting from employees' services provided to the reporting date and are

calculated at undiscounted amounts based on remuneration wage and salary rates that the Association expects to pay at the reporting date including related on-costs, such as workers compensation insurance and payroll tax.

b. Other long-term benefits

The Association’s obligation in respect of long-term employee benefits other than defined benefit plans, such as long service

leave, is the amount of future benefit that employees have earned in return for their service in the current and prior periods plus related on-costs; that benefit is discounted to determine its present value, and the fair value of any related assets is

deducted. The discount rate is the Reserve Bank of Australia's cash rate at the report date that have maturity dates

approximating the terms of the Association's obligations. Any actuarial gains or losses are recognised in profit or loss in the period in which they arise.

c. Retirement benefit obligations: Defined contribution superannuation funds

A defined contribution plan is a post-employment benefit plan under which an entity pays fixed contributions onto a

separate entity and will have no legal or constructive obligation to pay further amounts. Obligations for contributions to defined contribution superannuation funds are recognised as an expense in the income statement as incurred.

2022 $

2021 $

2.2 Other expense

Lynx: Agent and WNBL fees, game and medical costs

225,759 66,957 203,582 487,729 1,135,719

92,705

47,995 127,128 133,132 859,759

Motor vehicles

Entertainment, events, and functions Travel and accommodation

Other Expenses

2,119,746

1,260,719

72 | BWA ANNUAL REPORT 2022

P a g e | 72