Page 83 - 2022 BWA ANNUAL REPORT

P. 83

WESTERN AUSTRALIAN BASKETBALL FEDERATION INC.

Notes to the financial statements

for the year ended 31 December 2022

Note

5 Non-financial assets and financial liabilities (cont.)

5.2 Property, plant, and equipment (cont.)

Leasehold improvements are depreciated over the shorter of either the unexpired period of the lease or the estimated useful lives of the improvements.

The carrying amount of plant and equipment is reviewed annually to ensure it is not in excess of the recoverable amount from these assets. The recoverable amount is assessed as the lower of the carrying value and the depreciated replacement cost of an asset. The assets’ residual values and useful lives are reviewed and adjusted, if appropriate, at each balance date.

d. Derecognition and disposal

Gains and losses on disposals are determined by comparing proceeds with the carrying amount. These gains and losses and included in the income statement. When revalued assets are sold, amounts included in the revaluation relating to that asset are transferred to retained earnings.

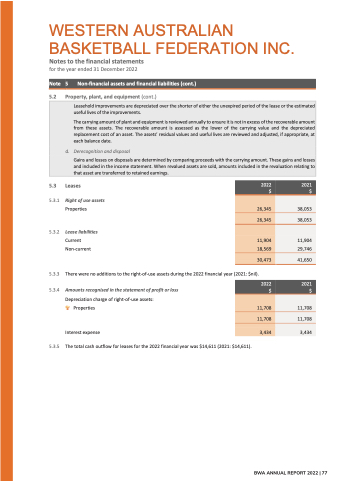

5.3 Leases

5.3.1 Right of use assets Properties

5.3.2 Lease liabilities Current

Non-current

2022 $

2021 $

26,345

38,053

26,345

38,053

11,904 18,569

11,904 29,746

30,473

41,650

5.3.3 There were no additions to the right-of-use assets during the 2022 financial year (2021: $nil).

Interest expense

5.3.5 The total cash outflow for leases for the 2022 financial year was $14,611 (2021: $14,611).

2022 $

2021 $

11,708

11,708

11,708

11,708

5.3.4 Amounts recognised in the statement of profit or loss

Depreciation charge of right-of-use assets: Properties

3,434

3,434

P a g e | 77

BWA ANNUAL REPORT 2022 | 77