Page 20 - KevinBriertonCaliber

P. 20

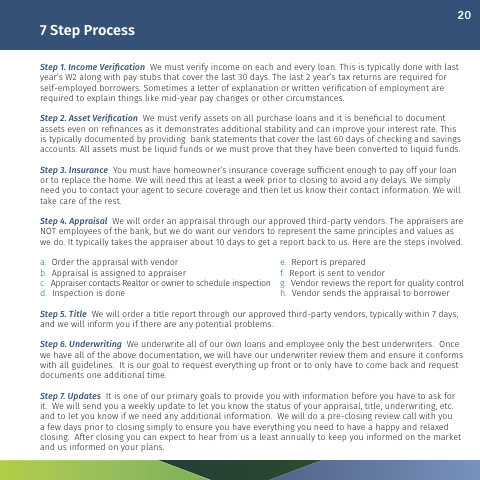

7 Step Process

20

Step 1. Income Verification We must verify income on each and every loan. This is typically done with last year’s W2 along with pay stubs that cover the last 30 days. The last 2 year’s tax returns are required for self-employed borrowers. Sometimes a letter of explanation or written verification of employment are required to explain things like mid-year pay changes or other circumstances.

Step 2. Asset Verification We must verify assets on all purchase loans and it is beneficial to document assets even on refinances as it demonstrates additional stability and can improve your interest rate. This is typically documented by providing bank statements that cover the last 60 days of checking and savings accounts. All assets must be liquid funds or we must prove that they have been converted to liquid funds.

Step 3. Insurance You must have homeowner’s insurance coverage sufficient enough to pay off your loan or to replace the home. We will need this at least a week prior to closing to avoid any delays. We simply need you to contact your agent to secure coverage and then let us know their contact information. We will take care of the rest.

Step 4. Appraisal We will order an appraisal through our approved third-party vendors. The appraisers are NOT employees of the bank, but we do want our vendors to represent the same principles and values as we do. It typically takes the appraiser about 10 days to get a report back to us. Here are the steps involved.

a. Order the appraisal with vendor

b. Appraisal is assigned to appraiser

c. Appraiser contacts Realtor or owner to schedule inspection d. Inspection is done

e. Report is prepared

f. Report is sent to vendor

g. Vendor reviews the report for quality control h. Vendor sends the appraisal to borrower

Step 5. Title We will order a title report through our approved third-party vendors, typically within 7 days, and we will inform you if there are any potential problems.

Step 6. Underwriting We underwrite all of our own loans and employee only the best underwriters. Once we have all of the above documentation, we will have our underwriter review them and ensure it conforms with all guidelines. It is our goal to request everything up front or to only have to come back and request documents one additional time.

Step 7. Updates It is one of our primary goals to provide you with information before you have to ask for it. We will send you a weekly update to let you know the status of your appraisal, title, underwriting, etc. and to let you know if we need any additional information. We will do a pre-closing review call with you

a few days prior to closing simply to ensure you have everything you need to have a happy and relaxed closing. After closing you can expect to hear from us a least annually to keep you informed on the market and us informed on your plans.