Page 66 - FY18 Advanced Services Strategic Plan

P. 66

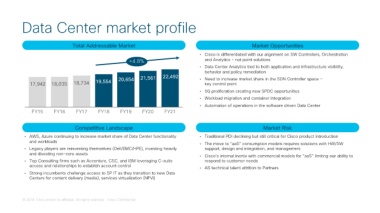

Data Center market profile

Total Addressable Market Market Opportunities

• Cisco is differentiated with our alignment on SW Controllers, Orchestration

+4.8% and Analytics – not point solutions

• Data Center Analytics tied to both application and infrastructure visibility,

behavior and policy remediation

22,492

21,561

17,942 18,035 18,734 19,554 20,654 • Need to increase market share in the SDN Controller space –

key control point

• 5G proliferation creating new SPDC opportunities

• Workload migration and container integration

• Automation of operations in the software driven Data Center

FY15 FY16 FY17 FY18 FY19 FY20 FY21

Competitive Landscape Market Risk

• AWS, Azure continuing to increase market share of Data Center functionality • Traditional PDI declining but still critical for Cisco product introduction

and workloads • The move to ”aaS” consumption models requires solutions with HW/SW

• Legacy players are reinventing themselves (Dell/EMC/HPE), investing heavily support, design and integration, and management

and divesting non-core assets • Cisco’s internal inertia with commercial models for ”aaS” limiting our ability to

• Top Consulting firms such as Accenture, CSC, and IBM leveraging C-suite respond to customer needs

access and relationships to establish account control • AS technical talent attrition to Partners

• Strong incumbents challenge access to SP IT as they transition to new Data

Centers for content delivery (media), services virtualization (NFVi)

© 2018 Cisco and/or its affiliates. All rights reserved. Cisco Confidential