Page 18 - ASSET MANAGER 9 (EN)

P. 18

w

a t

p

s a

o m

d

e

e

s n

SWISS PLATFORMS WITH DIRECT SYSTEMS

PROVIDER

BANK

ANNEX- TOTAL

MGMT FEE

DEPOSIT FEE PER YEAR

TRX. COST

PRODUCTS

OTHER COSTS

TYPE

Descartes Finance

UBS, Vontobel,

CS, Julius Bär, ZKB

at least 0.80% per year

UBS: 0.6% Vontobel: 0.5% CS, Julius Bär, ZKB on request

none, no spreads either

Foreign fees and taxes

Robo Advisor cre individual inves recommenda

SWISS PLATFORMS WITH FUNDS & ETFS

Descartes Finance

UBS, Vontobel

from CHF 20,000

0.30% – 0.60% per year depending on strategy

UBS: 0.2% Vontobel: 0.5%

ETF costs (TER) are added

Mainly replicating ETFs from large providers, sometimes synthetic (ETC in

Robo Advisor wh instruments. A

models of asset With auto

Investomat (GLKB)

Glarner KB

from CHF 5,000

Flat rate of 0.6% per year

no

ETF costs (TER) are added

Especially iShares, but all ETF providers can be chosen

Robo Adv bu

Selma Finance

Saxo Bank

from CHF 5,000

Flat rate of 0.72 % per year. Stamp duty included

no

ETF costs (TER) are added

Especially replicating ETF from large suppliers, sometimes synthetic (ETC in exceptional cases)

Personalize

Swissquote Robo-Advisory

Swissquote

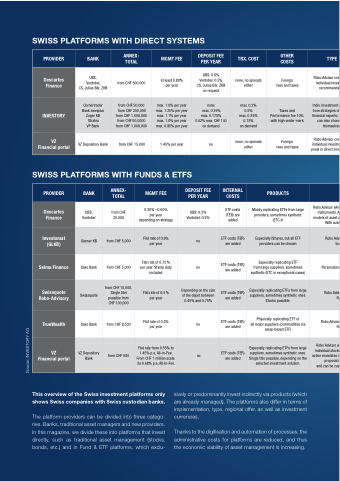

This overview of the Swiss investment platforms only shows Swiss companies with Swiss custodian banks.

The platform providers can be divided into three catego- ries. Banks, traditional asset managers and new providers. In this magazine, we divide these into platforms that invest directly, such as traditional asset management (stocks, bonds, etc.) and in Fund & ETF platforms, which exclu-

sively or predominantly invest indirectly via products (which are already managed). The platforms also differ in terms of implementation, type, regional offer, as well as investment currencies.

Thanks to the digitisation and automation of processes, the administrative costs for platforms are reduced, and thus the economic viability of asset management is increasing.

from CHF 500,000

INVESTORY

Cornèrtrader Bank zweiplus Zuger KB Strateo VP Bank

from CHF 50,000 from CHF 250,000 from CHF 1,000,000 from CHF 50,0000 from CHF 1,000,000

from CHF 10,000, Single titel possible from CHF 100,000

max. 1.0% per year max. 1.25% per year max. 1.1% per year max. 1.0% per year max. 0.85% per year

Flat rate of 0.5 % per year

none

max. 0.19% max. 0.175% 0.02% max. CHF 140 on demand

Depending on the size of the depot between 0.45% and 0.75%

ETF costs (TER) are added

max. 0.2% 0.5% max. 0.35% 0.15% on demand

Taxes and Performance fee 10% with high-water mark

Especially replicating ETFs from large suppliers, sometimes synthetic ones. Stocks possible.

Indiv. Investment from strategies of financial experts; i

can also choos themselve

VZ Financial portal

VZ Depository Bank

from CHF 15,000

1.45% per year

no

none, no spreads either

Foreign fees and taxes

Robo Advisor cre individual investm posal in direct inve

PROVIDER

BANK

ANNEX- TOTAL

MGMT FEE

DEPOSIT FEE PER YEAR

INTERNAL COSTS

Robo Advi R

TrueWealth

Saxo Bank

from CHF 8,500

Flat rate of 0.5% per year

no

ETF costs (TER) are added

Physically replicating ETF of

all major suppliers (commodities via swap-based ETF)

Robo Adviso R

VZ Financial portal

VZ Depository Bank

from CHF 500

Flat rate from 0.55% to 1.45% p.a. All-in-Fee. From CHF 1 million scale. 3a 0.68% p.a. All-In-Fee.

no

ETF costs (TER) are added

Especially replicating ETFs from large suppliers, sometimes synthetic ones. Single title possible, depending on the selected investment solution.

Robo Advisor w individual stock active mandates i

proposal i and can be cus

Source: INVESTORY AG