Page 37 - Demo

P. 37

THE EXCISE DEPARTMENT ANNUAL REPORT 2021 35

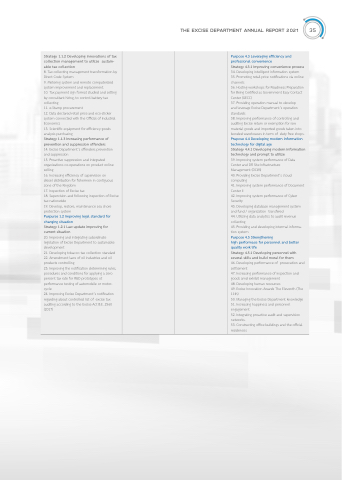

Strategy 1.1.2 Developing innovations of tax collection management to utilize sustain- able tax collection

8. Tax collecting management transformation by Direct Code System

9. Metering system and remote computerized system improvement and replacement.

10. Tax payment sign format studied and setting by consultant hiring, to control battery tax collecting

11. e-Stamp procurement

12. Data declared retail price and eco-sticker system connected with the Official of Industrial Economics

13. Scientific equipment for efficiency goods analysis purchasing

Strategy 1.1.3 Increasing performance of prevention and suppression offenders

14. Excise Department’s offenders prevention and suppression

15. Proactive suppression and integrated organizations co-operations on product online selling

16. Increasing efficiency of supervision on

diesel distribution for fishermen in contiguous zone of the Kingdom

17. Inspection of Excise tax

18. Supervision and following inspection of Excise tax nationwide

19. Develop, restore, maintenance sea shore protection system

Purpurse 1.2 Improving legal standard for changing situation

Strategy 1.2.1 Law update improving for current situation

20. Improving and integrating subordinate legislation of Excise Department to sustainable development

21. Developing tobacco tax collection standard 22. Amendment laws of oil industries and oil products controlling

23. Improving the notification determining rules, pocedures and conditions for applying a zero percent tax rate for R&D prototypes ot performance testing of automobile or motor- cycle

24. Improving Excise Department’s notification regarding about controlled list of excise tax auditing according to the Excise Act B.E. 2560 (2017)

Purpose 4.3 Leveraging efficiency and professional convenience

Strategy 4.3.1 Improving convenience proxess 34. Developing intelligent information system 35. Promoting retail price notifications via online channels

36. Hosting workshops for Readiness Preparation for Being Certified as Government Easy Contact Center (GECC)

37. Providing operation manual to develop

and leverage Excise Department’s operation standards

38. Improving performance of controllng and auditing Excise return or exemption for raw material goods and imported goods taken into bonded warehouses in term of duty free shops. Prupose 4.4 Developing modern information technology for digital age

Strategy 4.4.1 Developing modern information technology and prompt to utilize

39. Improving system performance of Data Center and DR Site Infrastructure

Management (DCIM)

40. Providing Excise Department’s cloud computing

41. Improving system performance of Document Center II

42. Improving system performance of Cyber Security

43. Developing database management system and fund / organization transfered

44. Utilizing data analytics to audit revenue collecting

45. Providing and developing intermal informa- tion system

Purpose 4.5 Strengthening

high performace for personnel and better quality work life

Strategy 4.5.1 Developing personnel with several skills and build moral for them

46. Developing performance of prosecution and settlement

47. Increasing performance of inspection and goods amd exhibit management

48. Developing human resources

49. Excise Innovation Awards The Eleventh (The 11th)

50. Managing the Excise Department knowledge 51. Increasing happiness and personnel engagement

52. Integrating proactive audit and supervision networks.

53. Constructing office buildings and the official residences