Page 143 - Capricorn IAR 2020

P. 143

NOTES TO THE CONSOLIDATED AND SEPARATE ANNUAL FINANCIAL STATEMENTS (continued)

for the year ended 30 June 2020

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

2.15 Revenue recognition

Revenue from customers is measured based on the consideration specified in a contract with a customer and excludes amounts collected on behalf of third parties. The Group recognises revenue when it transfers control over a service to a customer.

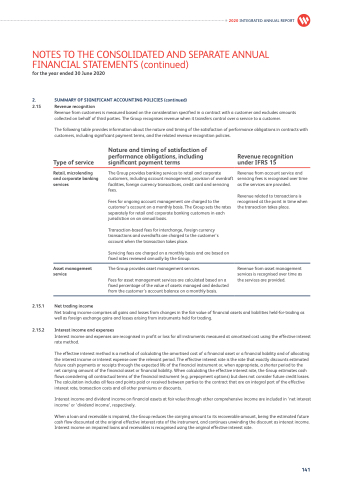

The following table provides information about the nature and timing of the satisfaction of performance obligations in contracts with customers, including significant payment terms, and the related revenue recognition policies.

Type of service

Retail, microlending and corporate banking services

Nature and timing of satisfaction of performance obligations, including significant payment terms

The Group provides banking services to retail and corporate customers, including account management, provision of overdraft facilities, foreign currency transactions, credit card and servicing fees.

Fees for ongoing account management are charged to the customer’s account on a monthly basis. The Group sets the rates separately for retail and corporate banking customers in each jurisdiction on an annual basis.

Transaction-based fees for interchange, foreign currency transactions and overdrafts are charged to the customer’s account when the transaction takes place.

Servicing fees are charged on a monthly basis and are based on fixed rates reviewed annually by the Group.

The Group provides asset management services.

Fees for asset management services are calculated based on a fixed percentage of the value of assets managed and deducted from the customer’s account balance on a monthly basis.

Revenue recognition under IFRS 15

Revenue from account service and servicing fees is recognised over time as the services are provided.

Revenue related to transactions is recognised at the point in time when the transaction takes place.

Revenue from asset management services is recognised over time as the services are provided.

2020 INTEGRATED ANNUAL REPORT

Asset management service

2.15.1 Net trading income

Net trading income comprises all gains and losses from changes in the fair value of financial assets and liabilities held-for-trading as well as foreign exchange gains and losses arising from instruments held for trading.

2.15.2 Interest income and expenses

Interest income and expenses are recognised in profit or loss for all instruments measured at amortised cost using the effective interest rate method.

The effective interest method is a method of calculating the amortised cost of a financial asset or a financial liability and of allocating the interest income or interest expense over the relevant period. The effective interest rate is the rate that exactly discounts estimated future cash payments or receipts through the expected life of the financial instrument or, when appropriate, a shorter period to the net carrying amount of the financial asset or financial liability. When calculating the effective interest rate, the Group estimates cash flows considering all contractual terms of the financial instrument (e.g. prepayment options) but does not consider future credit losses. The calculation includes all fees and points paid or received between parties to the contract that are an integral part of the effective interest rate, transaction costs and all other premiums or discounts.

Interest income and dividend income on financial assets at fair value through other comprehensive income are included in ‘net interest income’ or ‘dividend income’, respectively.

When a loan and receivable is impaired, the Group reduces the carrying amount to its recoverable amount, being the estimated future cash flow discounted at the original effective interest rate of the instrument, and continues unwinding the discount as interest income. Interest income on impaired loans and receivables is recognised using the original effective interest rate.

141