Page 152 - Capricorn IAR 2020

P. 152

GLOSSARY OF TERMS ANNUAL FINANCIAL GLOSSARY OF TERMS STATEMENTS

NOTES TO THE CONSOLIDATED AND SEPARATE ANNUAL FINANCIAL STATEMENTS (continued)

for the year ended 30 June 2020

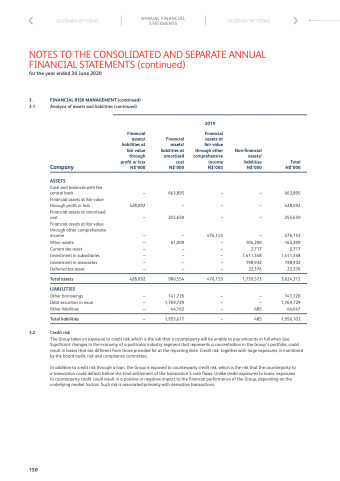

3. FINANCIAL RISK MANAGEMENT (continued)

3.1 Analysis of assets and liabilities (continued)

Financial assets/ liabilities at fair value through profit or loss Company N$’000

ASSETS

Cash and balances with the

central bank – Financial assets at fair value

through profit or loss 428,092 Financial assets at amortised

cost – Financial assets at fair value

through other comprehensive

income – Other assets – Current tax asset – Investment in subsidiaries – Investment in associates – Deferred tax asset –

Total assets 428,092

LIABILITIES

Other borrowings – Debt securities in issue – Other liabilities –

Total liabilities –

3.2 Credit risk

Financial assets/ liabilities at amortised cost N$’000

663,895 – 255,650

– 61,009 – – – –

980,554

141,726 1,769,729 44,162

1,955,617

2019

Financial assets at fair value through other comprehensive income N$’000

– – –

476,153 – – – – –

476,153

– – –

–

Non-financial assets/ liabilities N$’000

– – –

– 104,200 2,717 1,411,348 198,932 22,376

1,739,573

–

– 485

485

Total N$’000

663,895 428,092 255,650

476,153 165,209 2,717 1,411,348 198,932 22,376

3,624,372

141,726 1,769,729 44,647

1,956,102

150

The Group takes on exposure to credit risk, which is the risk that a counterparty will be unable to pay amounts in full when due. Significant changes in the economy of a particular industry segment that represents a concentration in the Group’s portfolio, could result in losses that are different from those provided for at the reporting date. Credit risk, together with large exposures, is monitored by the board audit, risk and compliance committee.

In addition to credit risk through a loan, the Group is exposed to counterparty credit risk, which is the risk that the counterparty to a transaction could default before the final settlement of the transaction’s cash flows. Unlike credit exposures to loans, exposures to counterparty credit could result in a positive or negative impact to the financial performance of the Group, depending on the underlying market factors. Such risk is associated primarily with derivative transactions.